Email marketing efforts are essential for engaging your customers regardless of how robust your marketing strategy is. Email marketing can significantly enhance client communication and retention in the insurance industry.

If you’re focused on conversions, that’s not the only goal. Even if email marketing doesn’t immediately bring in heaps of conversions, it plays a crucial role in reminding your clientele that you’re there and thinking of them.

Consider this: businesses typically see an impressive $38 return for every $1 invested in email marketing. The same potential exists for insurance email marketing. With a solid strategy, you can achieve remarkable returns on your investment.

In this blog post, we’ll look at the importance of insurance email marketing, how to craft them, successful examples, and more.

Let’s get started!

Table of Contents

Understanding Insurance Email Marketing

Let’s understand the importance of insurance email marketing for your business.

The importance of email marketing in insurance

Email marketing is an effective strategy for establishing connections with potential customers. According to Adobe, the average American professional checks business email for at least three hours daily and personal email for two hours.

This gives you ample opportunity to cultivate relationships with your clients. Here are some additional advantages of email marketing for insurance brokers.

Client engagement

Emails provide a platform to create targeted content for your audience, allowing for regular engagement and communication.

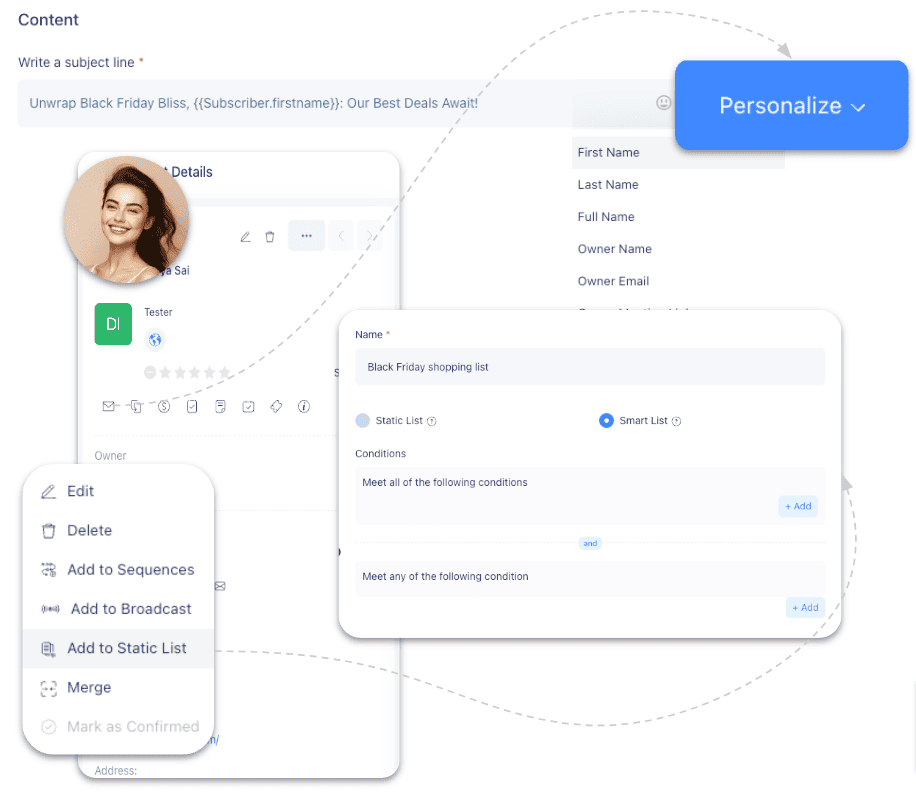

You can personalize your email content for different segments of your target group by including their names, sending birthday emails, and using a language that resonates with them. Leveraging email marketing tools to automate and personalize communication can significantly enhance engagement.

Personalizing the subject line has been shown to improve open rates substantially.

Another way to engage your clientele is by asking for feedback on your insurance services. Marketing something as intangible as insurance plans requires effort and constant trial and error to improve.

Customer retention

Customer retention is more important than acquiring new customers.

There, I said it. It’s not just because retaining existing clients is easier but because building loyalty is crucial in the insurance business. Clients who understand your new offers or plans and trust you are more likely to make additional purchases.

How does email marketing help with that? By keeping your existing clients updated on all your offers, deals, new plan releases, or newsletters, you add value to their lives.

This way, your clients are less likely to forget about you and may even spread the word about your services. The best part about client retention is the word-of-mouth referrals that increase organic conversions.

Lead conversion

How does email marketing contribute to heightened lead conversions? By strategically guiding your customer base through the sales funnel.

Yes, emails do that. Personalized and targeted messages can nurture your leads, directly influenced by clear CTAs and tailored offers. But that’s not all.

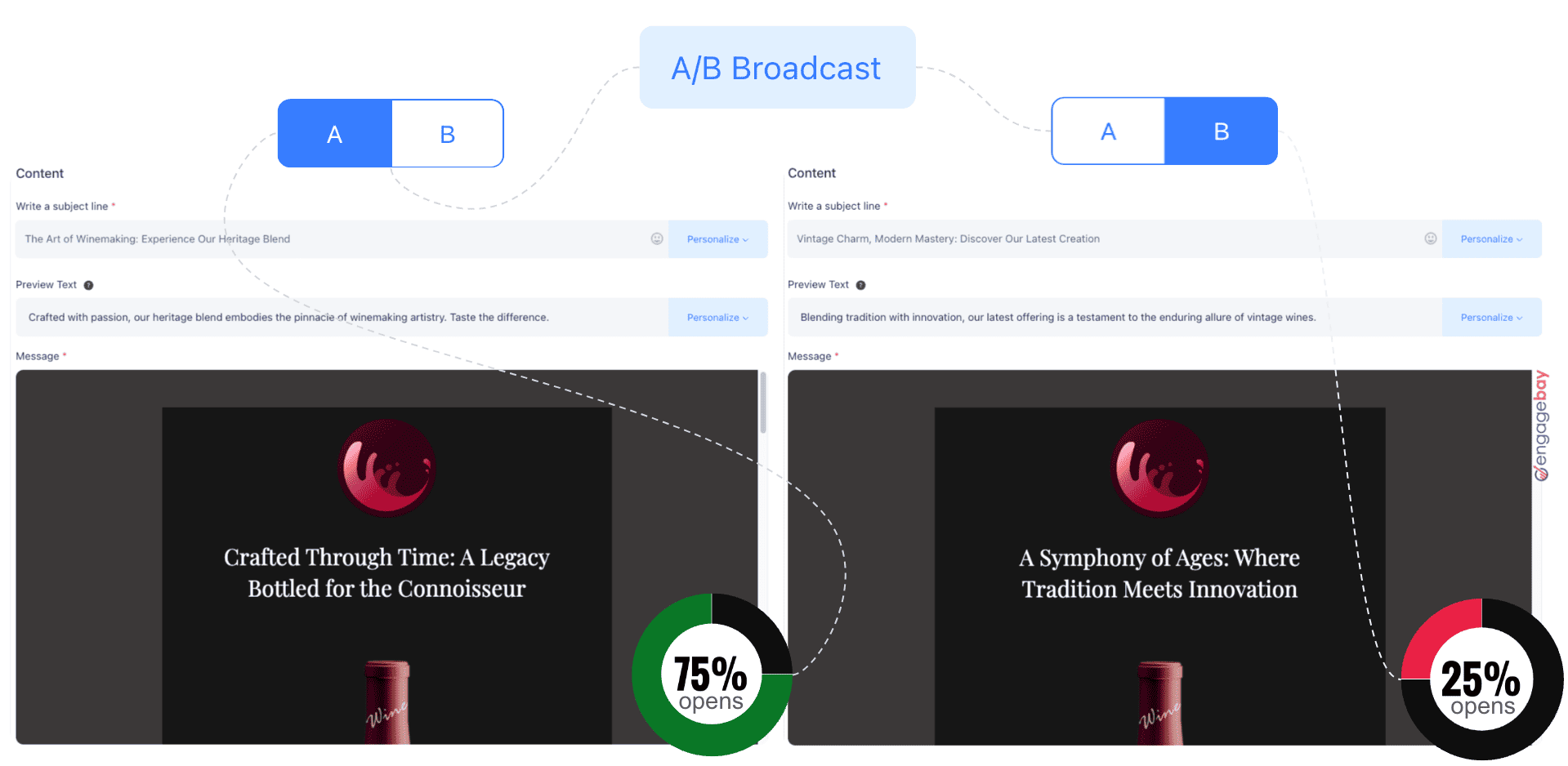

To drive conversions, you must also analyze your content performance with email clients, study the metrics, and conduct A/B testing to refine your strategy. If you’ve successfully implemented these tactics in your email strategy, you’re on your way to achieving better conversion figures.

How the insurance sector differs from other industries

As with every industry, insurance email marketing comes with its own set of challenges and opportunities. Let’s explore these in detail.

Regulatory considerations

Unlike many other industries, insurance is heavily regulated, with stringent laws governing data protection and financial services. While compliance is mandated, it should also be a common practice for insurance brokers and their marketing teams to adhere to these laws.

Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and other state insurance guidelines ensures that your clientele trusts you.

Insurance marketers must be well-versed in these regulations to observe legal compliance and protect client privacy when crafting and sending emails. For guidance, refer to insurance email marketing examples that comply with these regulations.

Unique customer needs

Recognizing that marketing insurance coverage differs from marketing a tangible product or service is crucial as an insurance agent.

Your customers may know little about your insurance plan beyond its literal meaning. Unlike retail or entertainment, where customers are already familiar with the product, you must educate your audience through email marketing campaigns.

Streamline your email content to provide valuable details about the specific insurance, its policies, terms and conditions, and other specifications.

Focus on how this insurance, which your target group may not even realize they need, can significantly benefit their lives.

Long sales cycles

Insurance is typically very time-consuming, as consumers need to evaluate different plans, analyze their situation, and assess all possibilities.

Unlike other sectors, where leads are closed quickly, insurance agents must monitor leads over extended periods.

Regularly sending emails to remind them of your insurance company’s brand and guide them through the purchasing process is crucial for keeping potential clients engaged and informed.

Opportunities for personalization

As with any industry, insurance email marketing comes with its challenges, but it also offers opportunities for customization.

Many insurance products are tailored to specific population groups and life stages, allowing you to segment your audience and present relevant materials to each category effectively.

Read also: 25 Genius Insurance Marketing Ideas You Haven’t Tried Yet

Getting Started with Insurance Email Marketing

If you’re convinced to start your insurance email marketing, read on to find the steps to setting up a working email marketing strategy.

Setting up your email marketing platform

The first step in launching your email marketing campaign is to choose the right platform. These platforms help you streamline your strategy and provide valuable insights. However, selecting the right one from many options can be challenging.

Choosing the right email marketing tools is crucial for automation and personalization, ensuring your campaigns are effective and engaging.

Before making a choice, consider if the platform provides ease of use.

You don’t want to waste time training yourself and your team when you could be maximizing opportunities. Instead, select an easy-to-learn and use platform that fits well with your team’s technical expertise.

Scalability is another critical factor. Your email marketing tool should handle your current data volume and scale with your company’s growth, accommodating larger datasets and increased functionality requirements.

Lastly, ensure the tool complies with regulatory requirements, including data protection and financial services laws.

Look for software providers that prioritize compliance with industry regulations such as HIPAA (for health insurance) and other state insurance regulations. Verify whether the software offers robust security features to safeguard sensitive customer information and maintain regulatory compliance.

Building and segmenting your email list

Effective email marketing begins with building and segmenting a robust email list to tailor messaging to different audience needs.

Segmenting your email list allows you to create personalized and relevant content for each audience group, enhancing engagement and improving conversion rates.

Strategies for collecting email addresses

There’s no need to reiterate the importance of collecting email addresses; it’s self-explanatory. Instead, let’s discuss various strategies to collect email addresses from potential customers.

Offer valuable content such as ebooks, guides, or webinars in exchange for email sign-ups. To capture visitor information, incorporate lead generation forms on your website, landing pages, and social media profiles.

Additionally, target insurance prospects specifically when collecting email addresses to ensure your email marketing efforts reach the right audience.

Read also: Insurance CRM Guide — What, Why, and The Best CRM Software Today

How to Craft Your Insurance Email Marketing Strategy

Now that you have chosen a platform and know how to gather and segment your email client list, let’s move on to crafting your insurance email marketing strategy.

Defining your objectives

Nothing works if you don’t know where you’re going. Dedicate proper time to determine your short-term and long-term goals.

Identify measurable goals, such as the number of lead conversions, email open rates or feedback engagement. These valuable parameters can streamline your efforts.

Common goals for insurance email marketers include increasing brand awareness, driving website traffic, boosting customer engagement, improving customer retention, and achieving a good return on investment.

With these goals in mind, you can customize your email content to serve your purpose better. Incorporating effective marketing strategies is crucial to achieving these email marketing objectives.

Audience segmentation and personalization

One of the key strategies for insurance email marketing that cannot be overlooked is audience segmentation and personalization.

Segmenting your audience and personalizing your emails ensures each recipient receives relevant and tailored content, increasing engagement and conversion rates.

Segmentation strategies

Make it your goal to segment your insurance audience so you can send more relevant messages to different recipients.

Use demographics such as age, gender, geographical location, and income bracket to divide the consumer market into segments.

Additionally, segment your audience by their stage in the customer lifecycle, such as leads, new customers, returning customers, or policyholders.

You can also segment based on the type of insurance the customers are interested in or require, such as car, life, or health insurance.

Personalization tactics

Personalization goes beyond just knowing your subscribers’ first names.

Use the data and analytical results to tailor the content of emails according to subscribers’ interests, activities, and interactions with your company and its products.

Add content blocks that can be personalized based on the recipient’s data, such as insurance products they may be interested in or quotes tailored to their needs. Implement dynamic subject lines and personalized copy in each message, utilizing the constants of the recipient’s persona.

Other strategies to consider include targeting the frequency and timing of email newsletters based on subscribers’ engagement levels.

Use welcome emails to connect with new customers and prospects, establishing a strong relationship.

Read also: 5 eCommerce Email Marketing Software to Help You Sell More

How to Create Engaging Insurance Email Content

Content is king! You’ve likely heard this everywhere on the internet, especially in digital marketing.

While it’s true in every sense, merely creating content isn’t enough. Creating engaging content that grabs attention from the subject line is crucial in email marketing.

Sounds intimidating?

Don’t worry. Follow this guide to create compelling email content for your insurance email marketing campaign.

Writing effective subject lines

Let’s see some tips on creating a subject line that makes your audience want to click:

- Be clear and concise: Keep your subject line short and to the point, ideally under 50 characters, to ensure it’s easily scannable and grabs attention quickly.

- Use personalization: Incorporate the recipient’s name or other personalized details to make the email more relevant and tailored to their interests.

- Create a sense of urgency: Use words that evoke a sense of urgency or exclusivity, such as “limited time offer” or “act now,” to encourage recipients to open the email promptly.

- Offer value: Highlight your email content’s key benefit or value proposition to entice recipients to open it. Focus on what’s in it for them and why they should care.

- Ask a question: Pose a compelling question in your subject line that piques curiosity and encourages recipients to open the email to find the answer.

- Use numbers or statistics: Incorporate numbers or statistics to add credibility and intrigue to your subject line. For example, “5 ways to save on insurance premiums.”

- Create intrigue: Tease the content of your email without giving everything away to spark curiosity and encourage recipients to click through to learn more.

- Test and iterate: A/B test different subject lines to see which ones resonate best with your audience and use the insights to refine your approach over time for better results.

Developing compelling body content

Once the recipient clicks on your subject line, your email body must impress them. Ensure your email body is quality-oriented and valuable to the user.

Follow these guidelines to enhance your email body content further.

Informative and relevant

Information is what binds your audience to your content. Therefore, keep your content as informative and value-worthy as possible. Ask yourself: Would you read that content if someone else sent you that email?

And if so, would it add value to your life?

To achieve this, add valuable information, tips, and insights into specific plans and address essential pain points with solutions.

This approach ensures your content remains engaging and beneficial to your audience.

Visual appeal

Content doesn’t just mean textual content. It also includes visuals that support your message. Ensure you complement your text with excellent visual elements like images, videos, or infographics.

Insert these elements regularly throughout your content to enhance engagement and readability.

Compelling storytelling

Stories live forever. Tell your audience ones that keep them engaged until you’ve made your sales pitch.

Include real-life use cases, justify with numbers, and give your readers a character to relate to. This makes your email more relatable and engaging than just discussing your insurance plan.

Clear call-to-action (CTA)

People need to be told what to do when they open your email. Once they’ve read through your content, they’ll wonder, ‘What’s next?’ That’s where call-to-action (CTA) buttons come into play.

Write a concise and clear CTA below your content or in a spot that’s easily noticeable and clickable by the recipient.

Use language that resonates with your target group’s typical dialogue. The goal is to encourage them to click, so make it emphatic and to the point.

Mobile optimization

Most of your recipients are checking their email on their phones.

In fact, 85% of people use smartphones to access email, according to Adobe. That’s why optimizing your email for mobile devices is crucial. Use responsive design techniques to ensure your emails render well on all screen sizes and devices.

Personalization

Let them know you’re talking to them personally.

Personalization helps a lot with that. Use their names in your salutations and subject lines, and incorporate the language they use or any famous sayings they might recognize. The goal is to encourage interaction through personalization.

Acknowledge their birthdays or any festive occasions when sending out your emails.

Test and iterate

A/B test different elements of your email content, such as subject lines, visuals, and CTAs, to see what resonates best with your audience.

Use the insights gained from testing to refine your email content and improve its effectiveness over time.

Examples of Successful Insurance Email Campaigns

While theories are a great way to learn, practical examples can be even more helpful.

If you’re an insurance marketer looking to enhance your email marketing for increased ROI, these use-case examples will provide valuable inspiration.

Additionally, following insurance email marketing tips is crucial for refining your messaging, converting prospects into clients, and gaining referrals through effective campaigns.

Personalized policy recommendations

Many leading insurance agents have tapped into the golden goose of email marketing. Not only does it allow them to send out personalized policy recommendations, but it also significantly impacts lead conversions.

Insurance agents like Geico send personalized emails to clients using creative visual and textual content. These emails are tailored to fit the audience’s attention criteria, resulting in a significant rise in open rates.

Analyzing customer data can help you tailor your content for your target group. Use individual needs and history to customize policy recommendations for them.

Additionally, leverage predictive analysis to enhance conversions and customer satisfaction.

Educational content series

Many insurance agents have also used email to educate their client base about their products. An email series of videos, texts, and images helped their audience understand the product in-depth without extra effort.

They covered topics such as understanding insurance coverage, managing policies, and the claim processes.

These topics add value to the audience’s existing knowledge base and genuinely interest them, rather than relying on flashy writing.

This valuable information enhanced customer engagement for these insurance agents, resulting in higher traffic and a greater return on investment.

Referral program promotion

Another insurance marketer found success with referrals through email. They introduced a referral program, encouraging clients to share the policy with friends and family in exchange for attractive incentives.

This enticing proposition, featuring special discounts and rewards, helped the firm quickly double its ROI.

They sent out referral content once a week, with referral notification emails on specific days to prompt users to refer more customers.

Using real-life testimonials from people who benefited from the referral program can maximize your email list’s potential. Generating insurance referral leads through email marketing is beneficial due to its low cost and high conversion rate.

Event invitations

An insurance agency found success by sending personalized email invitations to exclusive events, such as seminars, workshops, or networking sessions.

These emails provided customers with opportunities to interact with agents, learn about new products or services, and strengthen their relationship with the company.

Seasonal promotions

A regional insurance firm launched seasonal email campaigns offering special promotions or discounts during key periods, such as open enrollment or holiday seasons.

These targeted emails effectively captured the attention and drove sales by tapping into timely consumer needs and preferences. These use cases illustrate the versatility and effectiveness of email marketing in the insurance industry.

They showcase how personalized recommendations, educational content, referral programs, event invitations, and seasonal promotions can drive engagement and enhance customer relationships.

How to Optimize and Measure Your Insurance Email Campaigns

Here are some tips to help you optimize and measure the impact for your insurance email campaigns.

A/B testing and optimization

You can ensure your emails are operating at peak efficiency by conducting A/B testing.

Split testing is the only method to determine whether your email is better than the others, even though no two emails or email marketing campaigns are alike. It is reasonable to assume that a better version of your email will significantly improve your revenue and engagement rates.

Focus on testing subject lines, their length, how wordy they are, and what emojis they have!

Since they’re the most viewed element of an email, you can easily set them apart through A/B testing.

Analyzing campaign performance

Track key metrics such as open rates, click-through rates, conversion rates, and unsubscribe rates to gauge the effectiveness of your email marketing efforts.

Use email marketing platforms like Mailchimp, Constant Contact, or HubSpot to access detailed analytics and insights into subscriber behavior, campaign performance, and engagement levels.

By regularly analyzing these metrics, you can identify areas for improvement, optimize your campaigns, and achieve better results.

Conclusion

Leveraging email marketing for your insurance company can be crucial in driving conversions and establishing a strong brand presence among your customers.

Segregating your email directory, personalizing the content to fit each segment, and maintaining a balanced mix of textual and visual elements can significantly boost your insurance business. Choose a trusted tool for your insurance email marketing and start scaling your ROI today!

EngageBay is an all-in-one marketing, sales, and customer support software for small businesses, startups, and solopreneurs. You get email marketing, marketing automation, landing page and email templates, segmentation and personalization, sales pipelines, live chat, and more.

Sign up for free with EngageBay or book a demo with our experts.

Frequently Asked Questions (FAQ)

1. How can I ensure my insurance emails comply with industry regulations?

You can ensure the compliance of your insurance emails by verifying if you meet the privacy standards of the Health Insurance Portability and Accountability Act (HIPAA), California Consumer Privacy Act (CCPA), and other state regulations for insurance.

2. What are the best practices for segmenting an insurance email list?

Segment your insurance audience based on various criteria to deliver targeted messaging that resonates with different groups. Consider segmenting based on demographics such as age, gender, location, and income level.

3. How often should I send marketing emails to my insurance clients?

Try not to overwhelm your audience with your emails and newsletter, or you might end up in their spam folder before they unsubscribe. A decent email marketing cadence is to send out emails every two weeks. This will keep your clients interested.

4. Can I use email marketing for policy renewal reminders?

Yes. Reminding your audience that it’s time for them to renew their policy can lead to a high retention rate.

5. What are the best metrics to measure the success of my insurance email marketing campaigns?

How successfully your advertising efforts convert and bring in money for your company is the ultimate yardstick to measure. Metrics like leads, sales, revenue, profit, ROI, LTV, and CAC may be included in this.