As a business owner, one of the vital parts of your income statement is the net sales. It’s the basis on which you determine your net profit or net loss, as it accounts for your company’s total revenue within a given period.

A healthy income statement will help you make proper financial decisions, whether you run a brick-and-mortar or an eCommerce store. So, with net sales, you can understand the financial state of your business, as well as areas that need adjustment.

This article explains the concept of net sales, how to find net sales (the calculations involved), and a few examples to help you apply the same principles in your business. Additionally, it also reveals the differences between net sales, gross sales, and net income, as well as the areas where net sales cannot be applied.

Table of Contents

What are Net Sales?

Net sales simply refer to the company’s total sales within a specific period after subtracting the sales returns, allowances, and discounts. It is a vital part of a company’s income statement and is used to calculate gross profit.

Although net sales account for the allowances, sales returns, and discounts, it doesn’t account for the cost of goods sold (COGS), and other general or administrative expenses.

You can find the net sales of a company using the following formula:

Net Sales = Gross Sales – Sales Returns – Sales Allowances – Sales Discounts

What are the Components of Net Sales?

Four key components affect net sales:

- Gross sales

- Sales returns

- Sales allowances

- Sales discounts

1. Gross sales

Gross sales refer to the grand total of all sales made by a company over a specific period. It excludes all allowances, discounts, or other expenses incurred in the same period.

Although it reveals the total (gross) revenue a company generates, it is not an accurate metric for measuring the company’s true profit since it doesn’t give an account of the expenses incurred in production, shipping, packaging, etc.

Gross sales can be obtained by adding all sales invoices and other transactions that increase the company’s revenue. It can be calculated using the following formulas:

1. Gross Sales = Sum of all sales

2. Gross Sales = Total Units Sold x Original Sales Price

3. Gross Sales = Net Sales + Sales Returns + Sales Allowances + Sales Discounts

Example

An electronics company recorded the following sales in a month:

| S/N | Item | Price | Qty | Total Amount |

| 1. | Soundbar Bluetooth speakers | $179.99 | 12 | $2,159.88 |

| 2. | Mini smart speakers | $26.00 | 23 | $598.00 |

| 3. | Smart LCD TV | $249.99 | 12 | $2,999.88 |

| 4. | Smart plug sockets | $23.10 | 26 | $600.60 |

| 5. | Light bulb security cameras | $28.99 | 24 | $695.76 |

| 6. | PC VR headsets | $335.00 | 10 | $3,350.00 |

| $10,404.12 |

From the records above, the company’s gross sale for that month was $10,404.12. It didn’t show if discounts were given or if customers asked for a refund. As long as the sale was made, the amount was added to the gross sales.

Gross Sales vs Net Sales

Gross sales and net sales give information about how a company generates revenue. However, they have a few differences.

While gross sales include everything without accounting for the deductions, net sales subtract the deductions to give you a more accurate sales amount for that period.

The major differences between gross sales and net sales are as follows:

|

Gross Sales |

Net Sales |

| Gross sales account for the grand total of all sales made over a specific period, without any deductions. | Net sales account for the gross sales minus sales returns, sales discounts, and sales allowances. |

| Gross Sales = Sum of all sales | Net Sales = Gross Sales – Sales Returns – Sales Allowances – Sales Discounts |

| It doesn’t depend on the net sales | It depends on the gross sales |

| It is not always relevant | It is a relevant and more accurate financial metric |

| The amount is always higher | The amount is comparatively lower |

Sales returns

Sales return simply refers to a condition or situation when a customer refunds goods or products purchased, due to reasons like:

- Goods bought in excess

- Incorrect orders

- Delivery of the wrong products

- Delayed shipping

- Damaged or defective products

- Accidental orders

An increase in sales doesn’t always equal profit – mistakes happen. Due to several reasons, customers may return a product if it falls short of their expectations.

Revenues generated and recorded from sales returns are not included in the net sales since the money is lost through full or partial refunds and compensations, regardless of whether or not the company is able to resell the products again.

The sales returns are, thus, subtracted from the gross sales.

Example

If your gross sales for Q4 were $26,300 and your customers refunded $6,100 worth of goods, your net sales for that period can be calculated using the formula:

Net Sales = Gross Sales – Sales returns

Net Sales = $26,300 – $6,100

Net Sales = $20,200

👉Discover the most effective sales page examples that will transform your conversion rates in our detailed article! 📈

Sales discounts

Sales discounts are well-planned and approved deductions from the original prices of items. They’re usually expressed in percentages of the original prices. Companies periodically offer discounts to customers based on certain conditions, which may include:

- Time of the year

- Bulk buying

- Early payments

- New product sale

From your gross sales, subtract the sales discounts to find out your net sales.

Example

If you recorded $13,700 worth of sales in a month but offered a $1,300 discount in total, your net sales can be found with the following formula:

Net sales = Gross sales – Discounts

Net sales = $13,700 – $1,300

Net sales = $12,400

Sales allowances

Sales allowance is the price reduction a seller charges due to some order problems, such as incorrect prices, damaged or broken products, or shipping errors. It is similar to a sales discount.

However, a sales discount is planned and happens before the sales, whereas the sales allowance happens after sales and as compensation for errors or damages incurred.

Example 1

If a customer ordered a product priced at $5,000 but was billed $6,000, the sales allowance would be:

$6,000 – $5,00 = $1,000

Example 2

If a customer purchases 10 Honeycrisp apples for $2.99 each and discovers 4 of them are slightly bruised but still wants to keep the apples, the seller may decrease the prices of the defective items from $2.99 to $1.99. Therefore, the total sales allowance will be:

$1 x 4 slightly bruised apples = $4

Sales allowances can be seen as a partial refund or a rebate.

Calculation of Net Sales [Example]

Net sales can be calculated using the formula:

Net Sales = Gross Sales – Sales Returns – Sales Allowances – Sales Discounts

Example

A fictional clothing company, ABC Ltd., sold $49,800 worth of merchandise in Q4 (gross sales). But since it was during the festive season, they offered discounts worth $1,200 (sales discounts). Some customers didn’t like the products they got and requested a refund. The company accepted and refunded about $3,500 (sales returns).

Moreover, some items were damaged during shipping, but the customers agreed to keep the products. They only asked for a reduction in prices of the damaged goods, and the company accepted, granting a total of $4,800 worth of price reduction (sales allowances).

|

Particulars |

Amount |

| Gross Sales | $49,800 |

| Sales Returns | $3.500 |

| Sales Allowances | $4,800 |

| Sales Discount | $1,200 |

In calculating the company’s net sales, the sales returns, discounts, and allowances will be deducted from the gross sales. It can be calculated using the Net Sales formula:

Net Sales = Gross Sales – Sales Returns – Sales Allowances – Sales Discounts

Net Sales = $49,800 – $1,200 – $3,500 – $4,800

Net Sales = $40,300

Importance of Net Sales

Glad you made it this far 😄

In this section, we’ll look at why every business owner should know the nuances of calculating net sales.

1. Spotting products and discount errors

Since net sales account for the “losses” incurred from returns, allowances, and discounts, it helps you understand potential issues in your sales offerings.

If more customers ask for refunds or allowances due to damaged products, you may need to work on your product quality and shipping methods to ensure improved customer satisfaction. Also, knowing the impact of discounts will help you determine when and how to make special offers.

Likewise, you will be able to understand the products that need discounts and those that don’t.

2. Prices adjustment

Your net sales, being a closer representation of your net profit, can help you make better pricing decisions. You will be able to find out if your prices are too high or too low and where to make necessary adjustments.

Additionally, the information will enable you to discover your target audience and how to adjust your prices to meet their needs.

It also serves as a guide to help you know when and how to give discounts on specific items.

3. Understanding your business’s financial health

Net sales is a more accurate metric that reveals the true financial state of your business. As a metric, gross sales can be misleading and might make you overestimate your profits. For example, a company’s gross sales for Q1 were $49,000, and all deductions amounted to $5,200.

Excluding the expenses, the net sales would be:

Net Sales = Gross Sales – deductions

Net Sales = $49,000 – $5,200

Net Sales = $43,800

But if in Q2, the gross sales flew to $55,100 and at the same time a majority of the products were defective, with deductions amounting to $19,700, the net sales will be calculated thus:

Net Sales = Gross Sales – deductions

Net Sales = $55,100 – $19,700

Net Sales = $35,400

So, from both accounts, the company may experience a reduced net profit in Q2 regardless of the increase in sales.

Thus, a mere increase in your gross sales alone won’t give you an accurate account of your business’s financial health.

Limitations of Net Sales

- Net sales don’t apply to every company.

- It doesn’t account for general expenses, cost of goods sold (COGS), and other key components that would improve financial analysis.

Net Sales vs Net Income

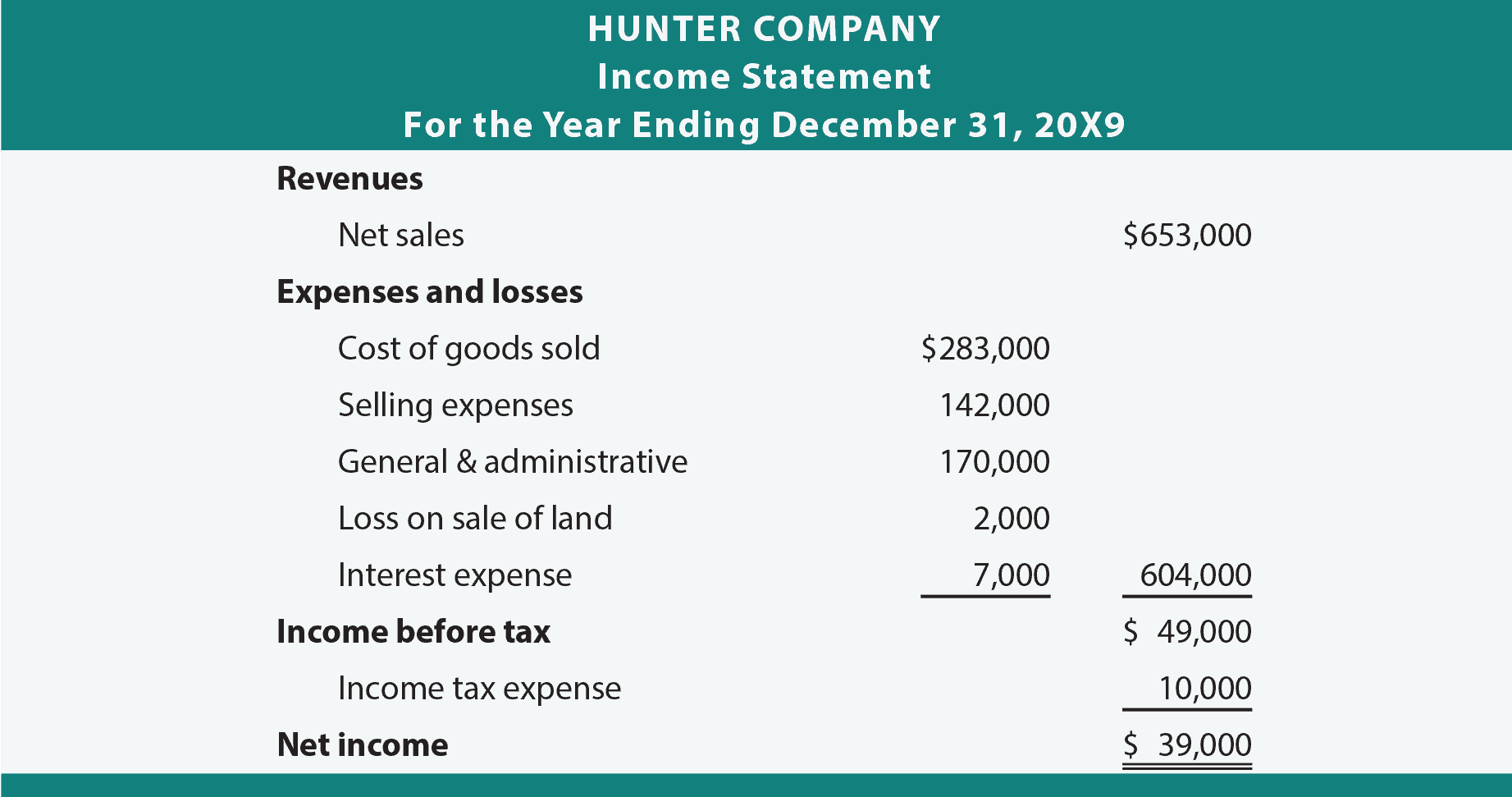

Net sales and net income (aka net profit) are two vital financial metrics you can find on a company’s income statement. It provides adequate information to help investors and readers know how profitable a business is.

Based on the information they account for, they differ in the following ways:

|

Net Sales |

Net Income |

| Net sales account for the gross sales minus sales returns, sales discounts, and sales allowances. | Net income accounts for the total amount left after deducting all expenses |

| Net Sales = Gross Sales – Sales Returns – Sales Allowances – Sales Discounts | Net Income = Total Revenue – Total Expenses |

| It’s found at the top of the income statement | It’s found at the bottom of the income statement |

| It doesn’t depend on the net income | It depends on the net sales |

| The amount is always higher | The amount is comparatively lesser |

The net income is usually the profit a company makes. It can be obtained from net sales by subtracting other expenses such as the cost of goods sold (COGS), depreciation, taxes, interest expenses, and SG&A (selling, general, and administrative expenses).

If the expenses exceed the revenue, it is calculated as a net loss.

Final Takeaway: Handling Your Net Sales

Your net sales help you figure out an accurate picture of your company’s revenue. Unlike gross sales, it gives you a more accurate income statement for measuring your profits or losses. The information you find in the reports will enable you to make better financial decisions and effective business strategies.

As your business grows, you can increase your net sales by improving the quality of your products, giving calculated and well-planned discounts, and staying up-to-date in your industry to know when to adjust your prices.

Additionally, using an all-in-one customer relationship management (CRM) software like EngageBay can help you automate your sales, marketing, and service operations, giving you more time to build stronger relationships with your customers.

With EngageBay, you can track your sales, connect with your customers, and monitor your performance over time. The features are well-designed to help you increase your net income.

Book a free demo to see how EngageBay enables you to increase your sales and retain customers. Alternatively, you can sign up for a free plan to get started.

Like what you read? Here’s some more content about sales:

Ace the Sales Process: 9 Simple Strategies Nobody Ever Talks About

5 Sales Tools and 6 Sales Techniques That Always Work

Sales Pitch: Everything You Want to Know (+ 9 Great Examples)