Financial technology, popularly called fintech, is the technology that automates and improves financial services in people’s everyday lives. Fintech companies have shifted banking and finance dynamics to become consumer-orientated.

In 2024, Cflow stipulates that one of the upcoming trends is banks and firms eradicating paperwork due to the rapid growth and competition that fintech companies bring.

The global fintech market will grow at a compound annual growth rate (CAGR) of 18.9%, rising to USD 501.9 billion by 2032.

The cause of this exponential growth is simple. Humans hate stress, and traditional banking incorporates stress, from taking longer to transact to higher transaction fees, a long filing process, and a lengthy time to open a bank account.

But despite the growing fintech market, they still face significant challenges. For instance, unlike traditional banks that have gained longtime consumer trust, fintech companies find building trust and retaining clients challenging.

In this blog post, I’ll walk you through 10 proven fintech marketing strategies to give you an edge in the fintech industry. Additionally, I review case studies for added inspiration.

Let’s get started, shall we?

Table of Contents

Major Hiccups and Challenges Fintech Companies Face

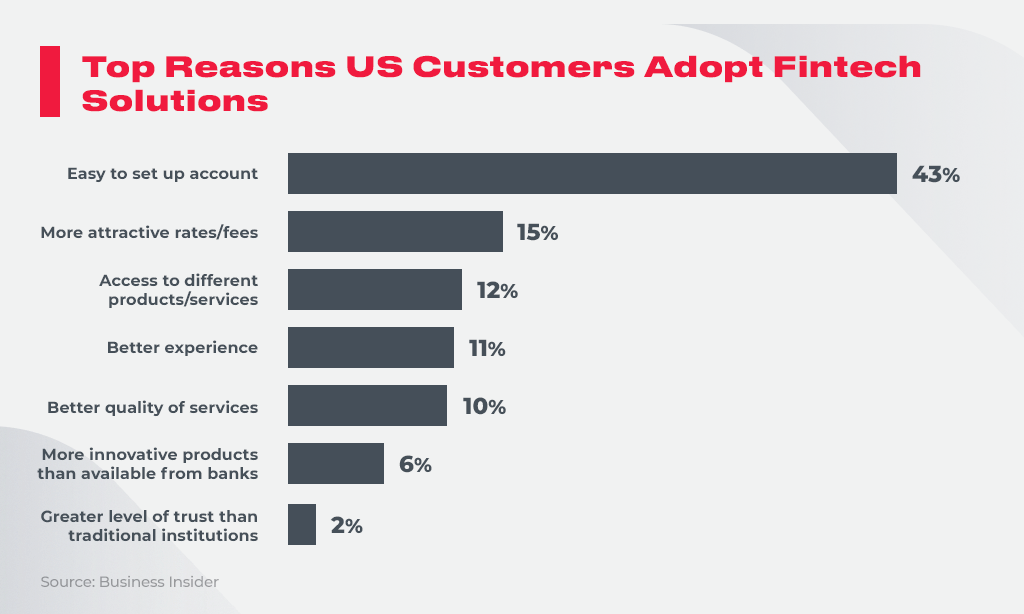

The top reason users gravitate towards fintech is due to its ease of use and ease of set-up.

However, fintech companies still face some challenges. Understanding these challenges is paramount in creating an effective fintech marketing strategy. Here are five unique challenges they encounter.

Customer attraction and retention

One of the significant challenges most fintech startups and companies face is attracting and retaining customers. There are several reasons for this: lack of trust, poor customer personalization, fierce competition, and data breaches.

According to Security Intelligence, fintech companies lose about $4.45 Million for every data breach, which can devastate startups.

High customer acquisition costs

On average, fintech companies spend a whopping $1450 for every new customer they acquire.

This cost can be justifiable based on what these fintech companies stand to get over the years from each customer. However, due to the high churn rate, market competition, and low switching costs, users may be less committed to staying loyal, making customer acquisition more expensive.

Considering the exponential growth in fintech, understanding the nuances between traditional and digital banks is crucial. Tools like Morning Download offer comprehensive insights into financial trends that can assist fintech companies in strategizing effectively.

High churn rates

After investing money to acquire customers, 73% of new customers churn after seven days. For the slightest inconvenience, they move to the next fintech app or regular bank, leading to loss of money on all sides.

Scaling is expensive

Scaling operations to accommodate customer growth can take time and effort and requires infrastructure, technical know-how, and operational efficiency to be successful. All these come at a high cost.

Lack of brand trust

Trust is a scarce currency for new fintech companies. As such, they often need to spend years establishing trust and demonstrating security and reliability, which is crucial for winning customers in the long term. But it isn’t all gloom and doom, as you’ll see when we get into the fintech marketing strategies.

10 Proven Fintech Marketing Strategies with Examples

Having looked at some unique challenges fintech companies face, here are ten marketing strategies to implement in 2024.

They include digital and traditional marketing strategies and helpful tips whether you are a startup looking to attract new customers or a more established fintech company looking to increase retention rate and revenue.

- Build brand trust quickly

- Target the right audience

- Glean insights from success stories

- Put digital marketing to good use

- Market better with data

- Remain relevant through innovation

- Increase brand awareness through influencers

- Double down on marketing efforts with automation

- Build ‘thought leadership’ through content marketing

- Comply with industry regulations

Let’s take a closer look at each of them.

1. Build brand trust quickly

One common challenge fintech companies face is that people don’t trust them as much as traditional banks because every click carries financial weight.

Janine Hirt, CEO of Innovate Finance said this:

“We know that trust can be lost very quickly and can be quite slow to regain, as we’ve seen in the 2008 financial crisis. This is a big challenge for fintech because people will not use our services; they will not use new products unless they trust them.”

This further points to the importance of building trust as a pillar for sustainable growth as a fintech company. Building trust isn’t a sprint; it is a marathon.

However, you can build brand trust faster by consistently demonstrating choices that portray transparency, security, authenticity, and customer prioritization.

Every interaction matters, from client onboarding to the first action taken, and is an opportunity to lay a foundation of trust. Show commitment to data security by implementing best-in-class security protocols like encryption, multi-factor authentication, and regular security assessments.

Additionally, it makes sense to showcase real customer success stories and positive testimonials on your website and social media. Seeing genuine experiences builds trust and inspires others.

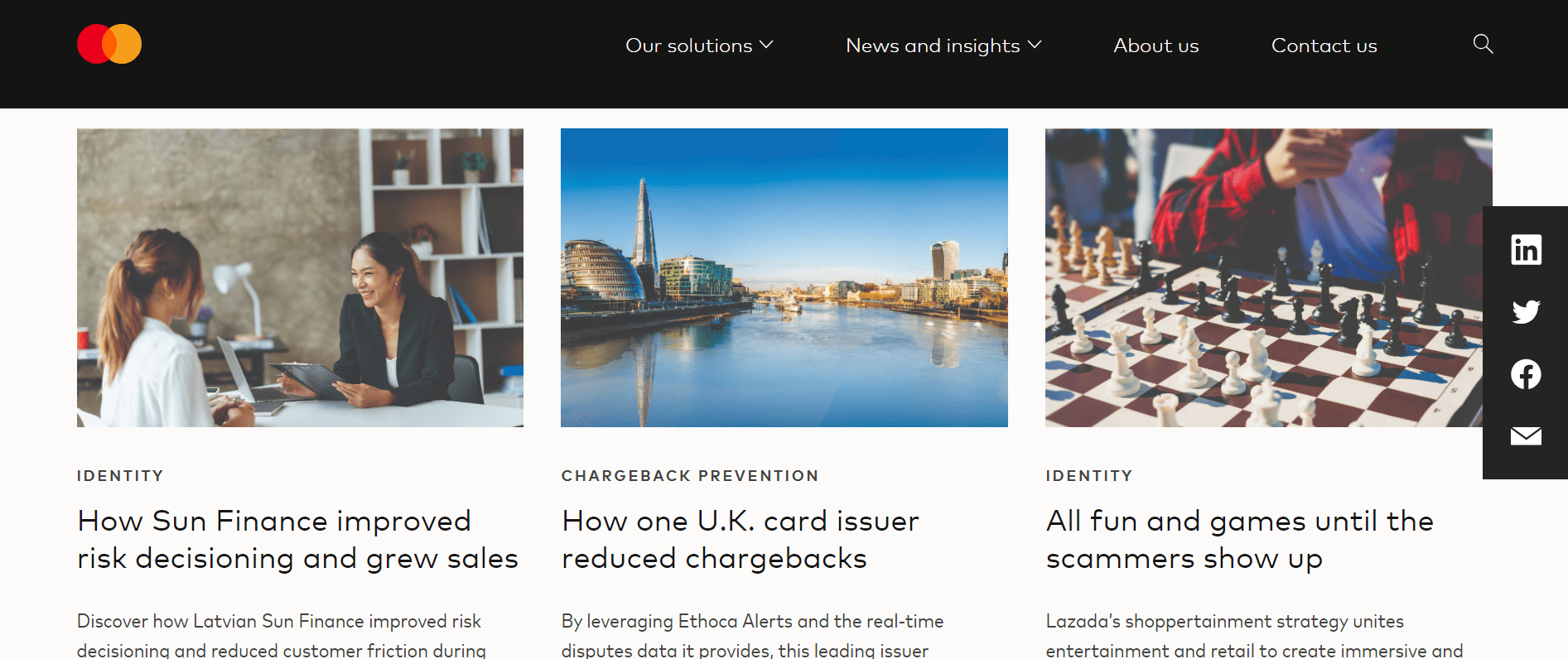

Mastercard has a page dedicated to sharing customers’ success stories to build trust and inspire others to take action.

Referral marketing and loyalty programs are also strategic tools for building trust in your fintech company, especially when implemented alongside the strategies discussed earlier. Here’s how.

Referrals leverage existing relationships to build new ones. When trusted friends or family recommend your product or financial services, it fosters social proof and boosts trust among potential users. On the other hand, loyalty programs cultivate users’ sense of belonging and shared financial goals.

This sense of community builds trust and encourages positive interactions, further reinforcing your brand’s trustworthiness.

2. Target the right audience

An essential key to improving business is to target the right customers. Targeting the wrong customers can be likened to a player who keeps missing the goalpost. You know the result: there will be efforts but no goals!

Targeting the right audience means you market your fintech services and products to an audience likely to choose your products and financial services above competitors. That way, you create personalized content, meet your audience’s needs, and give them a better overall marketing experience.

To attract the right audience, you must:

- Have a clear message

- know your unique selling point (what makes you stand out in the market)

- Have a clear buyer persona (let’s briefly look at a buyer persona and the steps involved in creating one)

A buyer persona is an in-depth description of who your ideal customer is. By understanding your buyer persona, you know your target audience and then tailor your fintech marketing strategies to attract them.

Steps to create a buyer persona

Here are three quick steps to create a buyer persona.

Analyze existing customer data

Start with the data available to you. Check for purchase history, customer demographics, and customer feedback. A CRM tool could serve as a repository of the needed information, enabling you to identify and analyze who your current customers are.

Carry out detailed customer research

If you are a startup, this will be your first step. Iterate the core problems your fintech product solves and the possible audience needing such services. Analyze their demographics, location, earning capacity, interests, and pain points.

For example, MoneyLion, a Fintech company founded in 2013, offers its customers financial advisory and investment services, and its target audience is Americans who live on day-to-day paychecks. This Fintech company allows consumers to loan money and pay with little interest.

Conversely, Payoneer is a fintech solution that allows business owners, freelancers, and companies to make and receive payments globally.

So, while MoneyLion’s target audience is Americans living on day-to-day paychecks (often referred to as the “underbanked” or “gig economy” workers Payooner’s target audience is business owners, freelancers, and companies who need to make and receive international payments.

Develop individual personas

Divide your audience into crucial segments and create a detailed persona for each. To make each persona more relatable, give each one a name and personality.

From the example above, MoneyLion’s buyer persona can be represented this way:

- Name: Sarah

- Age: 28

- Location: Atlanta, Georgia

- Occupation: Freelancer

- Financial situation: Lives paycheck to paycheck and struggles to save for the future

- Money goals: Improve financial stability and build an emergency fund

- Pain Points: Feels overwhelmed by finances, lacks trust in traditional banks, wants accessible and personalized financial guidance.

Sarah represents many Americans who need reliable and affordable financial tools to overcome challenges and achieve their goals.

For Payoneer, it may look like this:

- Name: Michael

- Age: 42

- Location: London, England

- Occupation: eCommerce business owner

- Financial situation: An established business with international customers but needs help with cross-border payments and tax compliance.

- Money goals: Expand business globally and streamline international payments

- Pain points: Time-consuming and complex international payment processes

Overall, Michael represents the growing number of global businesses needing efficient and secure cross-border payment solutions. By developing a buyer persona like this, you have insight into your ideal customers, where you can find them, and the most effective way to market to them.

Read also: B2B Manufacturing Marketing Strategy: The Blueprint For Success

3. Learn from fintech success stories

One of your Fintech company’s most effective marketing strategies is to learn what is working from others. You’ve heard the slang ‘If you can’t beat the wagon, join in.’

Joining the wagon is only good in some situations. In marketing, however, it is a great way to know what works while improving on it for better results.

To help your Fintech company refine its marketing strategies, you can’t help but study top Fintech companies who have gathered the trust of their customers.

Let’s look at some top fintech companies and see what we can learn.

1. Cash App

You may know something about Cash App’s history if you’re familiar with Twitter, now known as X. It was co-founded by Jack Dorsey, the founder of Twitter, in partnership with Jim McKelvey under their company name, Square Inc.

Square Inc. released CashApp in 2013, and ever since then, it has been evolving its fintech services to satisfy customers. As of 2018, CashApp surpassed Venmo and PayPal in downloads with 33.5 million cumulative downloads. Some marketing lessons to learn from Cash App include:

Performance marketing

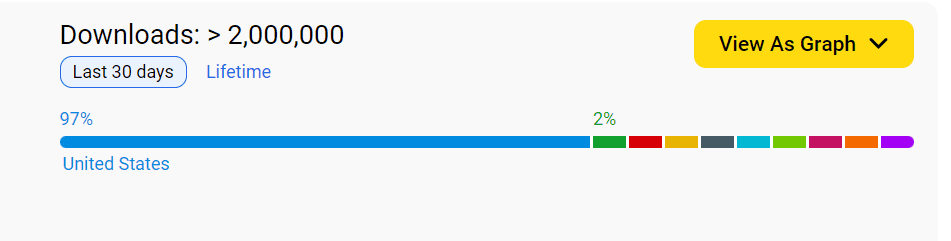

Cash App is big on performance marketing, a broad term given to the marketing strategy where you pay marketing agencies or advertising companies for marketing results achieved, in this case, app downloads.

The results? Over two million downloads.

Modify fintech services by keeping up with trends

In line with trends, after the rise of digital currency, Cash App evolved to keep in demand with people’s desire to trade cryptocurrency by allowing customers to buy cryptocurrency with its app.

So, beyond just sending and receiving money, you can buy Bitcoin, purchase stocks, and even file your taxes on a single platform using their Cash App Taxes feature.

2. PayPal

This fintech company was created in 1998 and has become one of the best platforms for sending and receiving money. One unique selling point about PayPal that makes it ideal for eCommerce merchants is it allows seamless integration of customers’ website stores.

Besides that, here are other fintech marketing strategies we can deduce from PayPal.

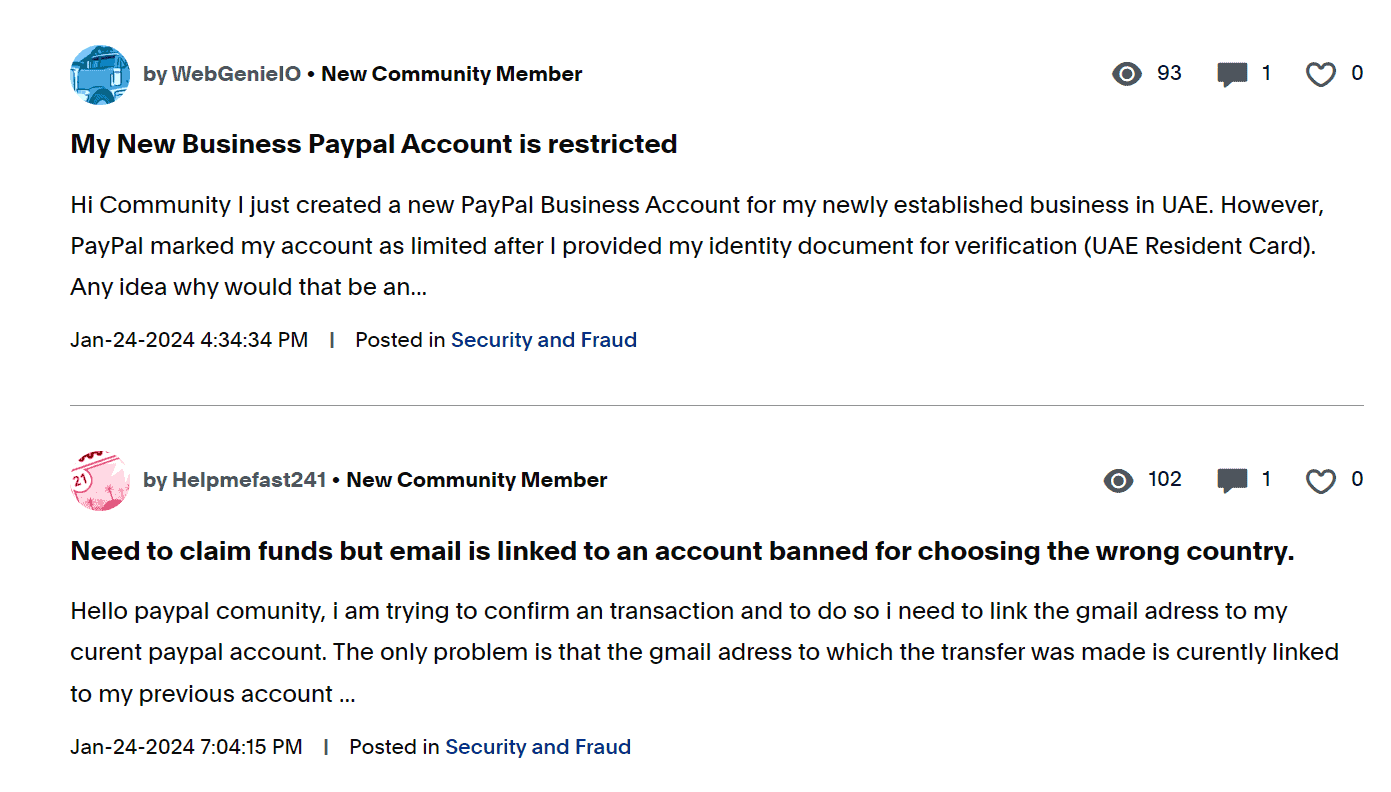

Build a community forum

Beyond building a community on social media, PayPal has a community forum allowing users to communicate and get online support.

Apart from communication and support, users in the community have access to incredible features like earning a badge, real-time collaborations, etc. This fosters a sense of belonging to a community and further drives engagement.

Strategic partnerships

Over the years, PayPal has built strategic partnerships and collaborations with eCommerce platforms, major financial institutions, and industry experts, thus widening its reach and penetrating new markets.

This type of partnership provides a win-win scenario for the parties involved.

Active social media presence

Aside from their community forum, PayPal also has an active online presence. They promptly respond to customers’ queries and concerns. They also use a personalized tone and give quick responses to customers.

3. Flutterwave

If you’re a small startup that thinks growing your Fintech company is impossible, Flutterwave is the inspiration you need.

Flutterwave was founded in 2016 and is headquartered in San Francisco. It has helped over one million businesses make online transactions. Some lessons to learn from Flutterwave include:

Innovation during crisis

During the 2020 pandemic, while small businesses couldn’t reach customers, Flutterwave innovated beyond offering fintech services.

They extended to create a digital store to help businesses reach their customers. In an interview with CNN, the CEO said the Flutterwave store was created in response to the Pandemic.

Besides offering financial services to help individuals, they also innovated to help small businesses.

Philanthropy and social responsibility

Flutterwave goes further in making an impact by empowering young people. Activities like this endear people’s hearts towards your brand because everyone loves to be a part of ‘doing good’ and charity.

Happy team = better performance

Another core lesson from Flutterwave is how it manages its team by acknowledging and supporting them on their personal growth and development journey.

They also have a friendly work culture that enables team members to function at their peak.

4. Betterment

Betterment, an investing company, was created in 2008 by Jon Stein and Eli Broverman. It is an app-based independent robo-advisor that provides digital investment and cash management services, extending its tentacles to retirement services.

Betterment became a brainchild of Jon Stein after he suffered severe losses while investing. He then proceeded with three others to create Betterment(Jon, Seal, Eli, and Ryan). In 2023, Betterment had $36+ billion as assets under management.

Some lessons to learn include:

Unique financial servicing

Key takeaways from Betterment are its unique services, such as the robo-advisor that considers customer preferences, goals, and attitudes.

Furthermore, this robo-advisor automatically gives recommendations and sets up a financial platform in line with the investor’s priorities and changes over time. Once you click on the Betterment site, you’re asked the right questions to start your investment portfolio.

Make it easy and understandable

Aside from the financial services Betterment offers, it also makes investing easy.

As we stated earlier, finance is a complex topic that many people must be aware of due to its complexities. Still, Betterment simplifies Investing by handling the technicalities behind it and making it fun for customers.

Betterment also handles the tax impact of investing for their customers.

Read also: 7 Powerful Moving Company Marketing Strategies in 2024

4. Put digital marketing to good use

Digital marketing is simply selling your products and services online.

While in times past, billboards, Newspaper ads, and direct mail were utilized to reach customers, there’s a total shift now to using the Internet to reach new markets and strengthen bonds with existing customers due to changing customer behavior.

About 89% of Americans go online daily, and 31% are constantly online. This shows that digital marketing isn’t optional but a must to meet new customers and continually communicate with existing customers.

There are several digital marketing strategies to incorporate into your fintech marketing strategy, such as:

- Social media marketing

- Email marketing

- Account-based marketing

- PPC advertising

- Content marketing

Social media marketing

A report shows that the top four goals that drive organizations to invest in social media marketing include building brand awareness, managing brand reputation, community building and engagement, and increasing sales conversion.

As of 2023, there were 4.76 billion users on different social media platforms, making social media channels crucial in creating brand awareness and generating leads for your fintech company.

Several brands are marketing their products on social media. Still, deciding the social platform to use based on your buyer persona is crucial to success beyond optimizing your social media profile.

Then, clearly define your marketing goals, clarify your marketing message, and build a community instead of coming off as too salesy—we all cringe at the sight of a brand that only cares to sell to us.

Different platforms are a better fit for different types of content. For instance, Instagram is excellent for short reels and image carousels, while X is better for short text-based posts. You also want to maintain consistent communication across your social platforms and marketing channels to build trust and grow authority.

To achieve this, sign up for a social CRM marketing suite that allows you to launch and manage your social campaigns and engage with your leads from one location.

Other helpful tips for building a solid social media presence include:

- Engaging with your audience and interacting with other brands

- Keeping up to date with industry trends and posing yourself as an authority by sharing helpful info

- Using visualizations such as graphics, sheets, and graphs to represent information and optimizing video marketing

- Using catchy headings and hashtags

Email marketing

Email marketing is 55% better at customer acquisition than Facebook and X(formerly known as Twitter) put together, which, if you consider, is a lot.

Unlike social media platforms with several metrics to thrive there, email marketing offers you direct and personal communication with your subscribers. Some types of emails to send as a fintech brand include:

- Transactional emails: Examples include account confirmations and payment reminders to build trust and transparency.

- Nurturing emails: Welcome emails and educational content fall under this category, and guiding customers through their buyer’s journey is essential.

- Promotional emails: Includes discounts, limited-time offers, and product launches. It is essential to drive revenue and product adoption.

- Engagement emails: This is helpful to re-engage inactive users and improve retention rates. Examples include surveys, win-back campaigns, and loyalty programs.

- Feedback emails: They help gather valuable insight and improve user experience, and they include surveys, pools, enhance user experience

Marketing automation makes it easy to personalize at scale and reach your email subscribers easily. Here are some key things to consider to get the most out of your email marketing efforts.

Proper segmentation

Segmentation entails dividing broad customers or consumers into subgroups based on shared characteristics.

It is dividing customers based on their needs and responses to marketing actions. Segmentation of customers could be classified into two broad categories:

- Demographics: Information like age, gender, location, and workplace. Sending financial education messages on handling debt might benefit workers, but it is inconsequential to students. Hence, there is a need for demographic segmentation.

- Behavioral segmentation: This is collated based on customers’ interaction with your services, their purchase history, and their level of engagement. Using a good CRM tool helps gather data for behavioral segmentation.

Personalize emails

It’s been noted that personalized emails generate 58% more revenue as compared to generic messages.

Personalizing messages sent to your Fintech consumers helps you stand out amongst competitors and enables you to retain customers due to increased customer satisfaction. Personalize customer onboarding, offers and recommendations, subject lines, and email content.

Account-based marketing

This is a focused growth strategy that personalizes the buying experience for customers. As a Fintech company, you can specifically target your audiences with specialized messages in every facet of your marketing platforms. Account-based marketing offers maximum ROI when integrated with the right CRM tool.

Here are two tips to get started with account-based marketing

- Personalize customer experience: One of the core things to implement in account-based marketing is to personalize consumers’ overall experiences. You can achieve this by customizing landing pages, websites, and newsletters.

- Build a customer-orientated team: To give your customers a seamless journey, all your team members must know your fintech company’s values. For instance, if a customer is confused about specific information and gets on a call with your team member, if the team member isn’t well informed and doesn’t answer the customer’s question satisfactorily, it may affect the client’s perception of your brand.

Content marketing

When your customers search for immediate answers to day-to-day financial issues, guess who they go to? If you said financial advisors, you thought wrong.

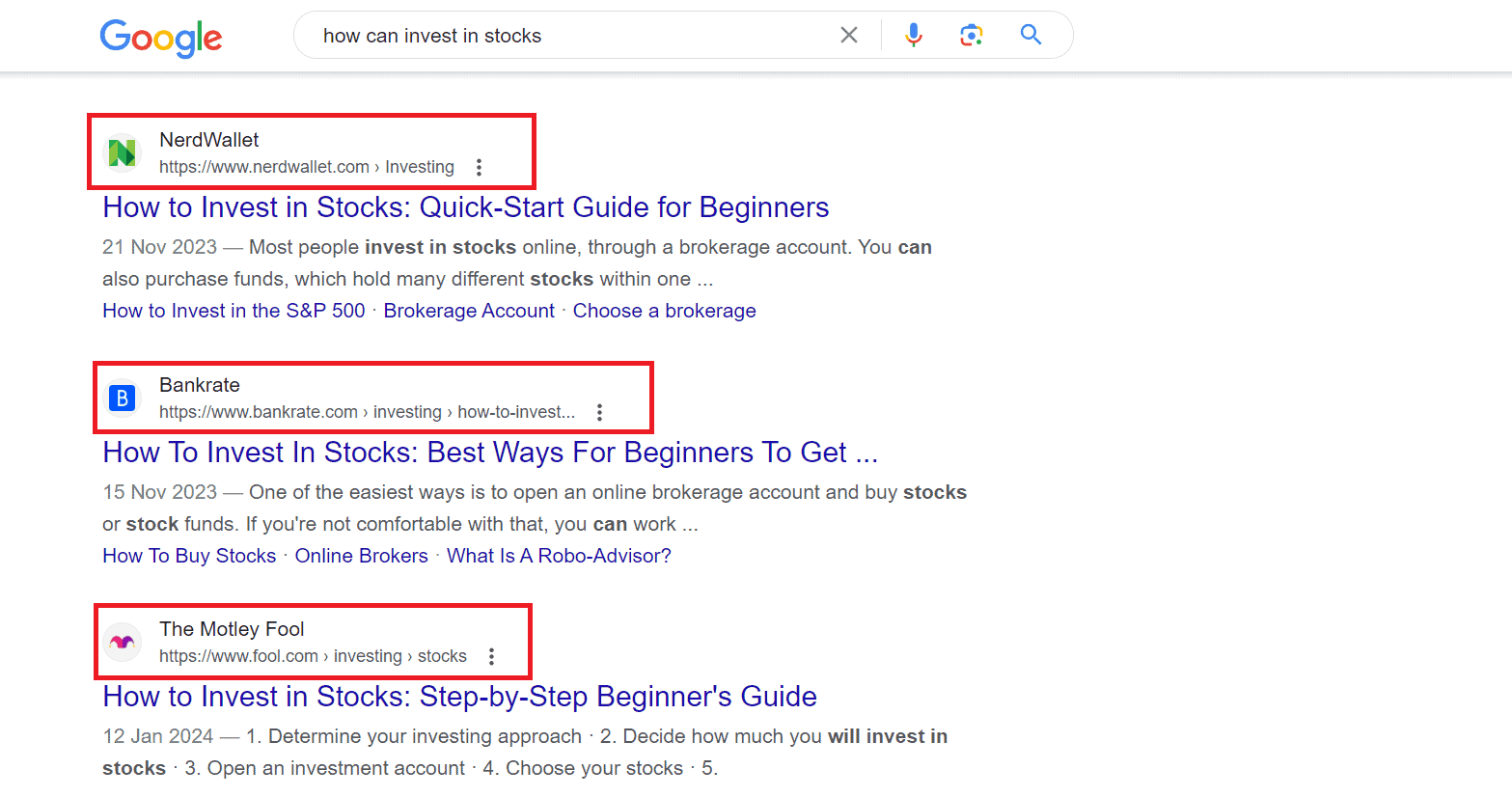

Research shows that over 8 billion search queries are made daily on Google to solve day-to-day problems, providing an excellent way to generate leads for your fintech brand and educate your audience.

For example, a quick search on Google for ‘How do I invest in the stock market’ brought up this result. Behind every query is a human in need of answers. Hence, you must maximize SEO content that helps solve people’s problems and attract new leads.

These brands, NerdWallet, Bankrate, and The Motley Fool, are all fintech companies personalized in personal finance. Investing in content marketing and answering people’s questions increases their visibility and attracts a pool of leads.

To win in content marketing, you have to think long-term. Through content marketing, builds customer relationships by proffering value and solutions to their questions and pain points. It aims to educate and inform your audiences about relevant topics.

Posting blog posts is not the zenith of content marketing. It’s the start. Content published to market your Fintech company must be SEO optimized, and if you’re unsure how to do that, think about consulting a specialized Fintech SEO agency.

Tips to create SEO content

Here are some tips to help you get started with SEO marketing

- Satisfy user search intent: One key thing to optimize SEO content is matching the searcher’s intent. More than just writing on cool topics is required. You must research to see if your audience is interested in such content. Here, the key thing is to research the problems your customers are going through and then create content that answers their problems.

- Offer quality content: When people think of SEO content, they think of keywords. The downfall is that most web content lacks depth and quality. Instead, they are stuffed with many keywords. While inputting keywords is good, making your content more informative and helpful for searchers is best.

PPC marketing

PPC marketing stands for pay-per-click.

It’s a digital form of marketing that could help reach more customers at a fee for each click. PPC will help your Fintech company pop up on the first page of search engines when people search for keywords related to finance. But unlike free content marketing, PPC is paid for.

Read also: 7 Kickass Bank Marketing Ideas You Can Steal

5. Market better with data

Data isn’t just numbers; it’s your secret weapon for precise fintech marketing and fuels informed decision-making. It reveals hidden patterns in demographics, behavior, and financial needs. This further helps you in customer segmentation so you can send personalized emails to each customer segment.

For instance, your chances of making better marketing ROI are higher when you target Gen Z on TikTok with investment tips and offer retirement packages to Gen X via emails compared to when you do it the other way around.

Data analysis also allows you to predict the future. That way, you can identify potential customers approaching key financial milestones (graduation, career change) and proactively reach out with relevant solutions. Think of it as being at the right place, at the right time, with the right financial advice.

In addition, data enables you to analyze website behavior and track your fintech marketing performance across social media, email, and paid ads through website traffic, conversions, and engagement metrics.

You’ll pinpoint where to double down on your efforts and get the most bang for your buck.

On EngageBay, for instance, you get to see how each marketing channel performs in real-time. So you know what works and what doesn’t work and refine your marketing strategy accordingly.

Data analytics tools to incorporate for refined marketing

Other data analytics tools to incorporate into your fintech marketing strategy include:

- Google Analytics: To help get accurate information on websites and see what content is working and what isn’t, Google Analytics comes into play. Offering web analytics, behavioral analytics, and Google Analytics can help you fine-tune your Fintech website to serve customers better.

- Tableau: This American company specializes in data visualization and business intelligence that can help Fintech companies in clear data visualization.

- Power BI: Power BI is a Microsoft product that helps Fintech companies in data collection of cash flow and budgeting. It also integrates with Windows Azure to manage hierarchical permissions, helping to improve your team’s communication flow.

- Qlik: This platform offers data integration and quality solutions using automated pipelines to deliver trusted, business-ready data, enabling more intelligent decisions, operational efficiency, and innovation. Also, it helps discover data insights and market trends.

- Splunk: This is a data software company offering Fintech companies a unified security and resilient digital world. That is a secure digital world.

6. Remain relevant through innovation

The fintech industry is like a moving train that is constantly evolving.

To stay relevant, you must innovate and keep up with trends. Identify unmet needs and leverage emerging technologies like AI, Big Data, or the Internet of Things to pioneer solutions. Here are some relevant innovations to incorporate into your fintech marketing strategy.

Gamification

This is rapidly growing in the fintech industry, helping financial companies engage users and turn routine tasks into rewarding activities. Gamification is simply the introduction of games into a non-game context. It gives customers a reason to keep using your fintech app due to the fun it delivers.

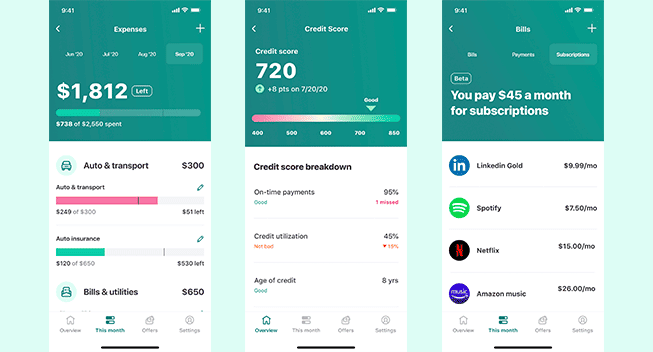

Revolut, PayPal, and Intuit Mint are examples of brands using gamification to improve customer engagement and user experience.

Reduce customer wait time with chatbots

Businesses worldwide use AI-powered chatbots to answer customer queries and reduce wait time.

As a Fintech company or startup, a modified AI chatbot with natural language understanding can help fast-track customer answers and improve customer experience. Beyond delivering fast answers, the modified AI chatbot offers personalized feedback rather than robotic answers.

Optimize for mobile

Research shows that over 6.3 billion people use mobile phones.

This means your site, pages, and apps must be in sync with the demands of mobile phones. Ensure your landing page has good site speed and is very responsive. The same goes for your website, social media handles, and mobile apps.

Periodically experiment with different innovative features and track their impact on user engagement and adoption. This approach helps you refine your ideas and launch solutions that resonate with your audience.

Read also: Trade Show Marketing Strategy: From Planning To Action

7. Improve brand reach through influencers

Influencer marketing is a sure way to build trust for your fintech company.

People often trust recommendations from figures they admire more than traditional advertising. Partnering with credible individuals or influencers for referral programs adds external validation and lends further legitimacy to your brand. Their reputation enhances your own.

According to research, 38% of people seek financial advice from financial advisors, and Social media influencers are the next go-to source for financial advice, ranking 32%. Influencers have built dedicated followings. By partnering with them, you promote your fintech products or services to their audience. This way, you build brand trust and humanize your brand.

Tips to get started with marketing with influencers: here are some helpful tips.

Utilize the right channel

As discussed earlier, different social media platforms exist, such as Instagram, Facebook, etc. To optimize influencer marketing, using the right platform is essential. The audience you want to reach determines the channel to use.

Source for the right influencers

Finding the befitting influencer for your Fintech Company is the next stage. You need to be deliberate in finding influencers whose values align with the core message of your Fintech company. For instance, an influencer discussing budgeting will be better suited for a fintech budgeting company than a stock company.

Infuse authentication

After signing up with an influencer, ensure that you show the full-fleshed authenticity of your Fintech services while still letting influencers’ creativity thrive.

Set clear goals

What do you want to achieve? Brand awareness, app downloads, or specific investment choices? Define your objectives to guide your campaign strategy and measure success.

8. Double down on your marketing efforts with automation tools

To make marketing easier and smarter, fintech companies must incorporate automation tools. By incorporating marketing automation, you accelerate growth, personalize at scale, and increase operational efficiency.

Marketing automation unlocks the power of dynamic content personalization. Imagine website banners, product recommendations, and CTAs that adapt to individual user profiles, creating a seamless and uniquely relevant experience for every visitor.

Additionally, rather than juggling between multiple tools in your marketing stack, some automation tools offer comprehensive marketing solutions that integrate sales, marketing, and support on a single platform.

For instance, EngageBay offers email marketing, customer support, CRM solutions, and marketing automation with extensive features on a single platform.

Read also: Navigating Chiropractic Marketing In 2024: A Brief Guide

9. Build brand awareness through content marketing

We discussed the need to solve customers’ financial issues through content marketing. According to reports, 77% of Americans long to be financially literate, and 75% claim they’d be more optimistic if they had a better understanding of finance.

This shows a huge market of individuals needing financial information and clarity. Offering content that enlightens the young population on financial topics is a marketing strategy to put in place.

You can achieve this by doing the following:

- Investing in videos. Facebook and Instagram show an affinity for short video content. A 1-2 minute video could capture and garner audiences.

- Creating evergreen content that answers customers’ questions.

- Making your content fun and easily digestible

- Posting simplified content. Financial topics are complex enough; don’t complicate it further.

Another great marketing strategy is investing in user-generated content. User-generated content (content created by your customers) means your audience amplifies your voice and shares their experiences with your fintech solutions.

These genuine contributions from real customers are a great way to build lasting connections and drive engagement. It encompasses reviews, testimonials, social media posts, videos, screenshots, and even creative interpretations of your brand.

10. Comply with industry regulations

After gaining customers to utilize your fintech services with all the marketing strategies placed above, the last thing you want to do is lose them.

According to the Consumers Financial Protection Bureau, the major key that makes all the difference is keeping your customers in mind, which says customers should be provided with fair, transparent financial products.

Refusal to follow the industry regulations can harm your brand and cause customers to leave your fintech brand as soon as they join. To prevent the instance of this, here are some helpful tips.

- Be transparent about the fees and services you offer

- In clear terms, state your terms and conditions.

- Show trust with the use of SSL certificates on websites and pages.

- Show testimonials of satisfied customers.

Read also: Interesting Insights From Samsung’s Marketing Strategy

Wrapping Up

Marketing your fintech brand isn’t a walk in the park. However, it is an investment that can potentially yield massive gains when done correctly. You don’t have to implement all the marketing strategies in this blog post simultaneously. Pick one or two first and add on as you go.

The key, however, is to build your fintech marketing strategy based on your current goals. For instance, If your main goal is to drive engagement, consider social media marketing and incorporating gamification into your fintech marketing strategy.

Conversely, consider influencer marketing or loyalty programs to improve customer retention and build trust.

EngageBay is a comprehensive marketing solution that enables you to build an efficient marketing stack in one platform. Sign up here to get started.

EngageBay’s guide to fintech marketing strategy is comprehensive. Essential reading for fintech professionals looking to scale their businesses!