Many players are involved in a dropshipping business, making dropshipping cash flow management a challenging task. Given its reliance on coordinating between various parties, this unique business model comes with specific cash flow management challenges.

With numerous independent parts to communicate with, such as suppliers, inventory managers, and shipping partners, errors are likely. This opens the door wide for cash flow errors and mismanagement.

Proper cash flow management is crucial for the survival of any dropshipping business. Staying organized with templates and tools can help you recognize overdue payments, devise strategies for cash gaps, and plan for future outcomes.

Maintaining consistent cash flow is essential for small businesses, though achieving it can be challenging due to the complexities involved.

This article examines these challenges, explores what they mean for dropshipping businesses, and shares essential tips and tools to help manage cash flow better.

In this blog post, we’ll explore the basics of dropshipping cash flow management, tips for effective management, and forecasting techniques.

Let’s get started!

Table of Contents

Basics of Cash Flow in Dropshipping

Cash flow is the lifeblood of any dropshipping business; it manages the inflow and outflow of cash, ensuring smooth operations.

For those who already have an online business, dropshipping can be an additional source of income. However, it depends on the seamless completion of orders and the necessity of attracting and engaging the target audience.

Understanding and managing cash flow is crucial, as the profit margin in dropshipping can be slim and highly dependent on these factors.

An industry survey revealed that approximately 82% of small businesses fail within the first two years due to inadequate cash flow management.

This statistic is even more critical for dropshipping businesses, which require precise timing of cash flows to coordinate order processing and fulfillment before receiving customer payments.

Cash flow issues are not unique to the dropshipping niche but are especially prevalent due to late customer payments, fluctuating supply costs, and other unpredictable expenditures.

For instance, a study shows that 93% of businesses suffer from delayed customer payments, exacerbating cash flow pressure.

Effective cash flow management is a powerful tool for dropshipping businesses, essential for sound financial management and stable growth.

By focusing on cash flow management, organizations can better navigate financial market fluctuations, ensuring they can sustain and grow continually.

How to Analyze Dropshipping Cash Flow

Analyzing your cash flow ensures your dropshipping business’s financial health and stability. Here’s a step-by-step guide on how to do it:

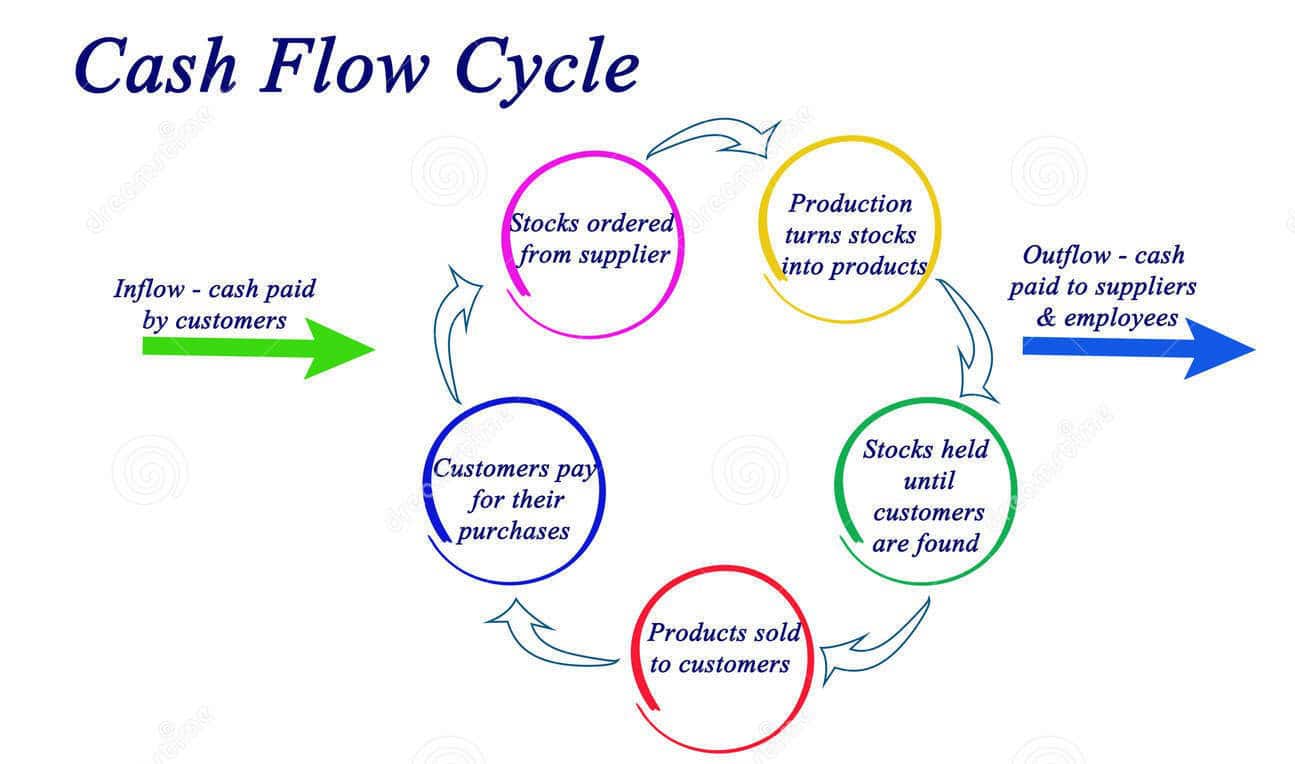

Understand your cash flow cycle

Start by breaking down the complex cash flow pattern for your dropshipping business to function well.

Identify when customer cash inflows begin and map them through all the expense categories or cash outflows, such as supplier payments and operational costs.

This forms the foundation for understanding and building efficient cash flow management.

Track and monitor regularly

Establish a strict routine for regularly tracking your cash flow. Consistency is key, whether this process is done weekly, bi-weekly, or monthly.

Regular tracking allows you to notice problematic areas and take corrective action on potential cash flow issues before they become major problems.

Leverage tools and software

Equip yourself with cash flow management tools like QuickBooks, Xero, or other inventory management software relevant to dropshipping.

These tools, ranging from spreadsheets to dedicated financial management platforms, can streamline your cash flow management, saving resources spent on manual processing.

These solutions help track and monitor cash flow efficiently, providing real-time information on cash movements and valuable data for decision-making.

Focus on key metrics

Shift your focus to basic metrics that can indicate the general state of your cash flows. Analyze metrics like Days Sales Outstanding (DSO), which describes the average time it takes to recover customer payments.

Additionally, examine ratios that measure your business’s inventory turnover to understand the performance of your inventory management system. These inventory turnover ratios are crucial for diagnosing your cash flow management strategies’ effectiveness and identifying improvement areas.

By concentrating on these metrics, you can address dropshipping’s cash flow issues with caution and precision. Proper understanding and advanced techniques pave the way to business success.

Read also: Discover What is Dropshipping and How You Can Do It

How to Improve Dropshipping Cash Inflows

Increasing cash inflows is a key strategy for improving the financial strength of your dropshipping business.

Maintaining a steady, positive cash flow is crucial for future financial planning. It ensures you can meet existing debts and reinvest in further business developments.

Here are strategic approaches to accelerate cash inflows and fortify your financial position.

Prepayments, deposits, and membership models

Prepayments and deposits: Encouraging customers to make partial or full-advance payments for their orders is one of the best strategies for improving cash flow management in your small-scale dropshipping business.

You can either add a surcharge to the ‘Cash on Delivery’ method to discourage its use or offer incentives for prepaid orders. This way, you can predict your cash flow and protect yourself against issues like order cancellations.

Membership models: Incorporate membership or subscription-based strategies that require customers to pay regular weekly, monthly, or yearly fees for certain privileges or services.

Offerings like regular discounts, early access to new items, and enhanced customer support encourage continued payments. This results in a more sustainable cash inflow approach.

Effective pricing strategies

Dynamic pricing: Develop flexible pricing models that enable you to change the price of your products based on prevailing market demand, competition, or other factors. This allows you to adjust real-time prices to maximize revenue without impacting profit margins.

Bundle offers and volume discounts: Encourage customers to spend more by establishing combos or offering lower-priced items with higher value. Although such strategies may lower the per-unit profit margin, they increase total units sold, thereby boosting cash receipts.

Partnerships with reliable suppliers

Supplier reliability: Choose your suppliers carefully and stick to well-established companies that offer quality products and reliable delivery. This helps you maintain the correct stock levels at the right time, keeping lead times low and minimizing disruptions or delays in your supply chain.

Inventory turnover optimization: Develop strong relationships with suppliers to ensure effective inventory management and maximize inventory rotation. This involves identifying and eliminating slow-moving or obsolete stock and adopting just-in-time inventory processing to improve cash inflows.

Read also: 7 Profitable Dropshipping Niches

How to Manage Dropshipping Cash Outflows

Just as managing cash inflow is essential for your dropshipping business, managing cash outflow is equally important.

You have timely payments to suppliers, shipping partners, and other parties involved in your business. Here are key strategies to optimize cash outflows and strengthen your financial position:

Negotiate better payment terms with suppliers

Engage suppliers in timely negotiations for better payment terms to improve your company’s cash flow. Negotiate longer credit terms with suppliers or offer extra discounts to customers to encourage early payments and enhance cash flow options.

Consider new ways of paying for inventory, such as consignment, where payment is made when the products are sold, reducing upfront expenses.

Minimize recurring expenses

Conduct a detailed analysis of regular expenses and daily activities to identify areas where costs can be minimized without causing practical inconveniences.

This might involve annually revisiting service contracts, switching to more affordable suppliers, or combining costs through volume purchasing.

Utilize technology to streamline operations and eliminate time-consuming tasks like manual labor for critical functions. This will enhance operational efficiency and reduce recurring expenses.

Set up emergency funds and build reserves

Setting up emergency funds to address unexpected monetary shocks or interruptions is essential.

Consistently set aside a portion of your income to build up reserves for covering expenses that arise unexpectedly or during specific periods.

One common strategy is to diversify your revenue sources, ensuring that you do not rely on a single stream of extra income.

This approach aligns with the goal of making your organization more flexible and adaptable in challenging market conditions.

By applying these measures, you can manage cash expenditures effectively, improving your company’s financial stability and strengthening the economic security of your dropshipping business, allowing for further growth.

Read also: The Pros and Cons of Dropshipping — Does it Actually Work?

Tips and Techniques for Effective Cash Flow Forecasting

Cash flow forecasting is a vital aspect of financial management for dropshipping businesses, providing valuable insights into future cash inflows and outflows.

We explore techniques for effective cash flow forecasting, leveraging historical data and market trends to predict future cash flows. Regular forecasting supports informed business decisions.

Understanding cash flow projection is a crucial aspect of forecasting that helps businesses plan for future financial scenarios.

Techniques for effective cash flow forecasting

Let’s take a look at useful techniques for effective cash flow forecasting.

Track income and expenses

Use Microsoft Excel sheets, budgeting applications, or accounting software tools to log income and expenses closely.

Conducted budgetary analysis to group expenditures by category and evaluated how to minimize spending within specific areas.

Separate costs not directly linked to product creation from those incurred in building brand awareness, fulfilling customer needs, or other organizational activities.

This disaggregation clearly explains how money is spent within the organization.

Create a budget

Collect income and losses for a given period and use these records to produce a suitable budget that fits the enterprise’s financial targets.

Allocate a percentage of that money to fund essential needs, pay off obligations, and contribute toward savings.

When setting a budget for your business, it is essential to allow some room for variance because business owners cannot always predict all expenses or revise their estimated incomes accurately.

Plan expenses

This can be achieved by effectively managing expenses during a fiscal period. Identify the ideal time for acquisitions and determine the costs for investments.

Instead of making random and irregular purchases, which may be inevitable, make anticipative purchases to control cash flow better.

Submit cash flow forecasts to identify when cash inflows and outflows are high or low and adjust expenses accordingly.

By coordinating expenditures with expected cash inflows, the business can avoid liquidity problems and sustain a sound financial status.

Set automatic payment schedules

Management should automate every recurring invoice or payment, such as insurance, rent, and utility bills.

Automating payment schedules ensures timely payments and reduces issues associated with manual bill handling.

Setting up regular payment routines helps organizations know when to make cash payments, making cash flow forecasting and planning easier.

Collect receivables quickly

Take additional actions to avoid slow receivables turnover, such as offering early payment discount incentives and upgrading the company’s invoicing and payment processing systems.

Instant receivables improve the business’s cash flow and reduce the chances of delinquent payments.

Integrate all revenue sources

Include all revenue streams in the cash flow forecast model, no matter how small.

This may include revenues generated through advertising, merchandise sales, subscription services, affiliate marketing, and any other applicable forms of revenue.

By considering all possible sources of cash receipts, you can provide a more realistic view of future cash inflows.

Account for variable and fixed costs

Fixed and variable costs must be incorporated into the cash flow forecast for all possible outflows.

Variable costs fluctuate with business activity, investments, or other variables, such as marketing and sales expenses.

In contrast, fixed costs remain constant regardless of business activity or investment levels, such as rent and employee salaries.

Incorporating these costs into your forecast allows more accurate control of spending on materials and services, reducing the risk of periodic cash shortages and avoiding unexpected cash signals to investors.

Consider external factors

While making these computations, it is also essential to consider several additional factors. Economic conditions, market trends, and legislative changes are parts of the external environment that can affect cash flow.

Changes in consumer behavior, legislation related to a particular industry, or currency exchange rates can significantly impact a business’s financial performance.

Awareness of these external factors enables organizations to revise or plan cash flows and finance-related activities, helping them avoid pitfalls and capture value-added opportunities.

Read also: How to Master Dropshipping Data Analytics for Success

How to Utilize Historical Data and Market Trends for Cash Flow Forecasting

Analyzing historical data and market trends is essential when preparing a cash flow forecast, as it provides a good outlook on future business performance.

Here’s an in-depth exploration of leveraging historical data and market trends for effective cash flow forecasting in dropshipping.

Data sources and methods

Diverse data sources: Historical data samples can be obtained from various sources such as financial and accounting documentation, sales and industry reports, and market research. Based on historical records, different methods like extrapolation, regression analysis, and scenario analysis can be used to predict future cash flows.

Extrapolation: This method uses assumptions about past experiences and trends or growth rates to estimate future cash flows. For instance, if a dropshipping project shows a 20% annual cash flow increase, the projection assumes growth rates will remain the same for future periods, such as the next two years.

Regression analysis: Regression techniques use statistical equations to determine the link between cash flows and other variables that explain them. Based on past results, regression analysis can establish the most suitable equations and forecast future cash flows as market elements change, such as the number of units sold.

Scenario analysis: For cash flow preparation, scenario analysis involves developing multiple cases to present different probable future outcomes. By extrapolating three trends based on historical data and probability estimates, businesses can prepare for various future contingencies.

By leveraging these diverse data sources and analytical methods, dropshipping businesses can create more accurate and reliable cash flow forecasts, helping them navigate financial challenges and capitalize on growth opportunities.

Best practices and tips

Multiple data sources and methods: Using multi-sourced information and a history-based approach can minimize methodological biases and increase the reliability of the findings.

Relevant sample selection: Maintain the credibility of the data by using historical information relevant to the current situation and representative of the organization. Check the data for outliers, anomalies, or non-recurring events to ensure accuracy.

Timely updates: Keep the cash flow forecast up-to-date by regularly analyzing historical data and reflecting changes in market, industry, and internal operations.

Range of estimates: Describe future cash flows using a range or distribution to account for variability rather than relying on a single expected figure. This approach provides a more realistic view of potential outcomes.

Read also: How to Create a Successful Dropshipping Business Plan

Benefits of regular cash flow forecasting

Regular cash flow forecasting is a part of managing your finances. Let’s take a look at the benefits.

Budgeting: Comprehensive budget creation

The main benefit of cash flow forecasting is that it helps develop detailed budgets to guide a business’s future financial expectations.

This calculation helps determine the amount required for a company’s investments, expenses, and business venture development in pursuit of its goals.

Financial planning: Informed decision-making

Cash flow forecasts are essential planning tools. They help businesses outline their strategies and make informed decisions regarding credit facilities and financial management.

Predicting future cash availability helps prevent problems and seize opportunities, ensuring the company’s resources are well utilized for future growth.

Cash shortages: Early detection of cash gaps

Business entities use cash flow forecasting to predict when they will likely face shortfalls in their cash positions, allowing them to take proactive measures to avoid such situations.

Cash flow forecasts enable workers to assess the organization’s funding requirements. They can then speed up collection procedures or seek alternative financing options to address cash flow shortfalls and maintain liquidity.

Debt repayment: Timely debt servicing

Budgets help organizations plan for possible events and implement strategies to meet contractual cash obligations, such as repaying debts and other interests when due.

By reconciling cash flow expectations with credit repayment schedules, firms can meet credit obligations, maintain good credit scores, and foster positive relationships with creditors.

Growth plans: Strategic growth management

Cash flow forecasting allows companies to determine how income and profits relate to growth strategies.

It helps businesses carefully assess the costs of procedures or the extent of expansion to avoid straining resources or growing prematurely.

Dynamic dropshipping businesses can use cash flow forecasting to improve these aspects, reducing vulnerability and increasing the chances of strategic development and success.

Read also: How To Find Reliable Dropshipping Suppliers — A Quick Guide

How to Leverage Financial Tools and Resources

Maintaining proper cash flow management is vital for the success of a dropshipping business.

Successfully managing cash flows in the current dropshipping environment is critical for long-term sustainability.

Here, we explore a range of financial tools and resources tailored to assist dropshipping businesses in optimizing cash flow management, along with guidelines for responsible utilization.

Line of credit

A line of credit offers businesses an open account up to a specified credit limit, which the firm can use as needed.

This type of credit product is convenient for addressing short-term liquidity shortages and various working capital costs, as it charges interest only on the amount used.

Short-term loans

Short-term loans provide a lump sum for a specified period, typically not exceeding one year, and are to be repaid in full by the due date.

Businesses use them for working capital, acquiring inventory, funding marketing campaigns, and repaying the loan with interest and the principal amount within the set time frame.

Invoice financing

Invoice financing allows businesses to use their invoices as collateral to receive cash advances from lenders, known as factors.

This process enhances cash receipts and helps manage liquidity issues by providing immediate funds without waiting for customer payments.

Business credit cards

Business credit cards provide a convenient and flexible source of financing for routine expenses such as inventory, advertising, and software subscriptions.

They offer a revolving line of credit, always available to the business owner, and can be repaid gradually over time.

Additionally, business credit cards often come with bonuses such as frequent flier miles or purchase rebates, adding value to business expense usage.

Equipment financing

Equipment financing allows organizations to obtain necessary equipment or machinery without incurring direct upfront costs.

This financing option involves making regular payments, enabling businesses to conveniently acquire the equipment they need for their operations.

Responsible use of financial tools

Assessing cash flow needs: Before applying the financial tools, define your dropshipping business’s exact requirements and goals. Identify the required amount of funding, the length of time it is necessary, and how funding options will likely affect cash flow.

Evaluation of terms and conditions: Compare various financial products, focusing on interest rates, associated charges, and loan repayment durations. Review multiple offers from different lenders to find the most favorable terms for your company’s finances.

Mitigating risks: Borrow sparingly and avoid taking on excessive credit to prevent your business from being overwhelmed by debt. Prepare a repayment schedule to help you repay the borrowed amount with minimal interest charges aligned with your cash flow forecasts.

By adequately utilizing these financial instruments, dropshipping businesses can effectively control expenses and meet short-term funding needs, fostering long-term sustainability and competitiveness in the e-commerce market.

Read also: How to Scale a Dropshipping Business — 7 Proven Strategies

Conclusion

Cash flow management is critical to sustaining the structure of a dropshipping e-commerce business. Managing the uncertainties of the e-commerce environment requires proactive measures, leveraging financial tools, and strategic planning. A business’s economic health and growth thrive through these techniques.

Policies and practices related to working capital management enable an organization to adapt to fluctuations in funding requirements. Adopting affirmative cash flow strategies is essential for any dropshipping business to achieve optimal results and maintain steady operations.

EngageBay is an all-in-one marketing, sales, and customer support software for small businesses, startups, and solopreneurs. You get email marketing, marketing automation, landing page and email templates, segmentation and personalization, sales pipelines, live chat, and more.

Sign up for free with EngageBay or book a demo with our experts.

Frequently Asked Questions (FAQ)

1. What are the first signs of cash flow problems in a dropshipping business?

Applicable signs are when your customers start to pay slowly. You cannot pay your suppliers as agreed, or your business bank account is overdrawn repeatedly.

2. How often should I analyze my business’s cash flow?

One must review cash flow statements at least weekly or monthly. This helps check actual and projected cash flow and identify any problems to solve.

3. Can technology significantly improve cash flow management?

Using accounting software, cash flow forecasting tools, and payment processing solutions can optimize processes and minimize errors. These tools provide an accurate picture of cash flows.

4. What are some common mistakes in managing cash flow that dropshippers should avoid?

Common errors include not creating a cash flow forecast and inflating revenues. Frequent mistakes include underestimating costs, ignoring outstanding receivables, and not setting aside emergency cash reserves.

5. How can I handle seasonal fluctuations in my dropshipping business’s cash flow?

Future planning happens through cash flow management, according to availability and sales volume at peak and off-peak seasons. This includes creating a cash reserve during high season, negotiating with suppliers for flexible payment terms, and cutting costs during low business periods.