Taking the right action concerning finances can be sketchy, and it involves a lot of work, which is why businesses and individuals opt for the expertise of financial advisors.

As a financial advisor, how do you effectively attract, manage, and keep your clients?

It’s no news that marketing is going into automation mode, and the financial industry isn’t left out. Here are some statistics.

- 72% of financial services companies are using marketing automation.

- 63% of financial advisors and marketers believe that automation curbed the time spent managing email campaigns.

- According to Forrester Research, businesses that implement marketing automation for customer engagement experience a 23% higher customer retention rate.

How?

- Marketing automation tools help you attract and nurture new leads across multiple platforms, saving you time to handle more technical business operations.

- With features like predictive lead scoring, campaign tracking, and dynamic content, you can send ulta-personalized messages automatically, increasing your chances of conversion.

Whether you are new to marketing automation and need help choosing a tool for your finance advisory firm or want to switch tools and want more options. We have you covered.

In this blog post, we cover:

- The best software tools in marketing automation for financial advisors

- Tips and best practices in marketing automation for financial advisors

Ready? Let’s dive in!

Table of Contents

Marketing Automation: A Quick Start On What It Is and Its Importance

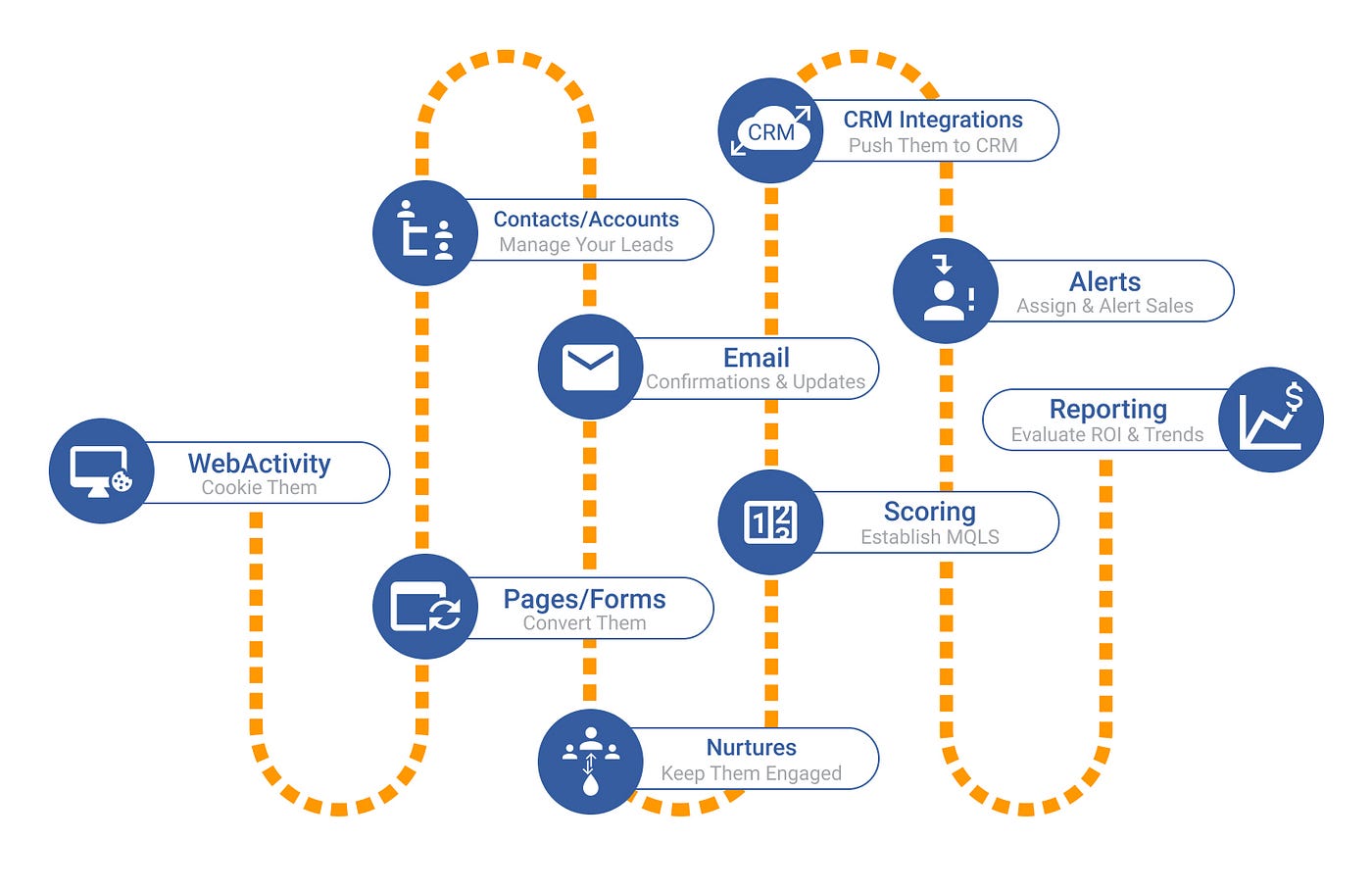

Marketing automation is a tech-driven strategy, i.e., it involves using software to make your marketing processes easy by removing repetitive tasks.

This improves the efficiency of your marketing strategy and provides a more personalized experience for your customers. As a finance advisor with an automation tool, you can do the following and more:

- Carry out omnichannel marketing, ensuring you have a steady stream of leads in your pipeline

- Send targeted messages tailored to clients from different industries and pain points, showing them how your services meet their specific needs

- Have your client’s data on a central platform for effective management and real-time updates on their interactions with various teams

- Improve customer service by integrating live chats on your website by reducing wait time

👉 Elevate your email marketing with our free email templates designed to boost engagement and conversions.

Benefits of Marketing Automation for Financial Advisors

There’s no end to the benefits of marketing automation in streamlining your business operations and marketing efforts as a financial advisor. Here are four benefits to begin with:

1. Better quality of leads

As a financial advisor, having a ton of prospects doesn’t mean they are sales-qualified or will ever convert. With marketing automation, you increase your chances of getting qualified leads through predictive lead scoring.

Here’s how it works.

Your marketing team will have a set of predefined actions and scores allocated to them, which will be added up as leads take those actions. For instance, when a lead attends an investment webinar organized by your firm, 20 points can be assigned, or if a lead books a one-on-one free consultation, 50 points can be assigned (depending on the score set by your marketing team).

This way, leads who score the highest are followed up with personalized messaging, increasing conversion chances.

This also ensures you have a constant stream of leads across the several stages in your sales pipeline. Because leads with lower scores can keep being nurtured with educational content that shows them how your service solves their problems, increasing chances for future conversion.

According to HubSpot, businesses that use marketing automation for lead nurturing experience a 451% increase in qualified fields.

2. Efficiency and time

Let’s be sincere: as a financial advisor, you have a lot of manual tasks to do, like appointment scheduling, checking the numbers, and nurturing leads across the various marketing channels and stages.

With automation tools like appointment scheduling, automated email sequences, send-time optimization tools, and the ability to manage your campaigns from a single platform rather than having many tabs open, it saves you more time to do productive work and focus on more technical business operations.

Read also: How To Nail Your Retail Marketing Automation [Tools, Examples]

3. Personalization

No one likes a generic one-size-fits-all campaign. Reports show that 76% of customers reported being more likely to purchase from brands that personalize their offers.

Let’s get it straight: personalization extends beyond slamming names on email broadcasts.

With marketing automation, you can personalize at scale, from dynamic messaging in email content and website visits to product recommendations and ads retargeting on social media. This increases your chances of connecting with leads and potential clients by addressing their pain points.

4. Client retention

It’s no new news that it costs you more to gain new customers than to retain new ones. Marketing automation doubles your retention efforts in the following ways:

- Automating your post-sales messaging

- Increasing the effectiveness of your customer support through live chat and automated response, reducing customer wait time, thereby increasing customer satisfaction

- Increases upsell and cross-sell opportunities through omnichannel marketing

- Keeping track of customers across multiple platforms to provide updates on services and offerings

Additionally, according to Lenskold, 63% of companies that outgrow their rivals use marketing automation for cost-effective marketing.

Read also: Marketing Automation Landscape: A Guide To Scaling Your Business

Enhance Your Email Marketing

Want to make your emails more impactful? Check out our beautiful, easy-to-customize recruitment and email templates. Designed to boost engagement, these templates from EngageBay will help your emails stand out. Just customize the images, headings, and CTAs for your brand, and hit send in a few minutes!

Types of Marketing Automation Tools

There are several types of marketing automation tools depending on marketing objectives, marketing channels, or goals. Let’s see what they are.

1. All-in-one marketing automation

Automation tools like EngageBay and HubSpot can be used to manage all aspects of your marketing, sales, and support efforts. Their built-in CRM (customer relationship management) lets you have all customer data and interactions with different teams on a centralized platform for real-time updates.

2. Email marketing automation

Email automation tools help capture leads, build email segments, and create automated email workflow based on user action.

For instance, an automated email sequence that shows leads what your services are about and how they solve their financial needs after they opt-in to receive your emails.

3. Social media automation

Properly scheduling and publishing content across various channels is always a hassle. Still, it becomes simplified when social media automation tools help with scheduling and publishing. With a social media automation tool, you can track metrics on different media platforms to gauge your marketing efforts.

A good example is SocialPilot.

Read also: The Future Of Marketing Automation: 12 Trends For 2024

4. CRM automation

Customer relationship management (CRM) automation tools are responsible for helping you manage customer data and improve the level of interaction between you as an advisor and the client. CRM automation tools can also help you track your customer interactions.

5. Content marketing automation

Content marketing automation is a software option that makes creating, publishing, and distributing content easy. The tools also help you track and analyze the results of the already published content.

6. Analytics and reporting automation

Analytics and reporting automation tools meet your need for tracking, measuring, and evaluating campaign performance. Analytics and reporting automation help analyze and provide solutions through insights concerning marketing campaigns.

Read also: Data-Driven Marketing Automation For Maximum Impact

The Best Marketing Automation Software for Financial Advisors

There are several marketing automation tools out there that you can use as a financial advisor. However, we considered ease of use, customer support, unique features, and user ratings for this list.

So, the top tools on our list of best marketing automation software (in no particular order) are as follows:

- HubSpot

- EngageBay

- MailChimp

- Klaviyo

- SocialPilot

- ActiveCampaign

- GetResponse

- Sprout Social

- Zoho Analytics

- Pardot by Salesforce

- Drip

- SharpSpring

- Ontraport

- Marketo Engage

Here, I’ve made a table for you to quickly go through the unique features, user ratings, and starting prices of these marketing automation software.

| Automation tool | Starting Price | Unique feature | Free Plan | Overall rating G2 |

| HubSpot | $45 | Account-based marketing | Yes | 4.4 |

| EngageBay | $13.74 | Predictive lead scoring, contact management, SMS | Yes | 4.6 |

| MailChimp | $6 | Campaign automation | Yes | 4.4 |

| Klaviyo | $45 | precise multi-channel attribution | Yes | 4.6 |

| SocialPilot | $25 | Social media management | No | 4.5 |

| ActiveCampaign | $49 | Omnichannel marketing | Yes | 4.5 |

| GetResponse | $13.2 | Free website builder | Yes | 4.2 |

| Sprout Social | $249 | Campaign success analytics | No | 4.4 |

| Zoho Analytics | $14 | Advanced analytics | No | 4.2 |

| Pardot | $1250 | Lead management | No | 4 |

| Drip | $39 | Drip campaigns | No (14 days free trial) | 4.4 |

| SharpSpring | $449 | Real-time alerts | No | 4.5 |

| Ontraport | $24 | CRM and A/B testing | No | 4.5 |

| Marketo Engage | Custom | Marketing management | No | 4.1 |

#1. HubSpot

The first marketing automation tool on our list is HubSpot. That’s because it is an all-in-one marketing software and is super popular. From lead capturing across multiple channels (emails, push notifications, and pop-up forms) to lead nurturing, multi-channel advertising and management can be done with HubSpot’s marketing automation features.

Additionally, you get advanced data reporting, which helps you make data-driven decisions for your business. For instance, HubSpot website tracking lets you know how online visitors interact with your website, the areas they clicked on, the duration of their visit, and where they are viewing from.

This can help your sales team understand what they are looking for and how best to nurture the lead based on their online behavior.

Calling multiple clients and keeping tabs on the information gathered can be tasking. With the HubSpot calling tool, you can keep track of present and past call interactions with each client.

Another beautiful feature of HubSpot is its SEO recommendation. One way to attract and nurture leads as a financial advisor is through blogging. HubSpot’s SEO recommendation tool helps you identify and fix errors so your blog post can rank higher on the search engine result page (SERP.)

Other features you’ll find in HubSpot include:

- An account-based marketing tool that helps you identify your high-value clients

- Omnichannel marketing

- Paid ads tracking

- Contract and campaign management

- Advanced marketing reporting

- Email and SMS marketing automation

Pricing

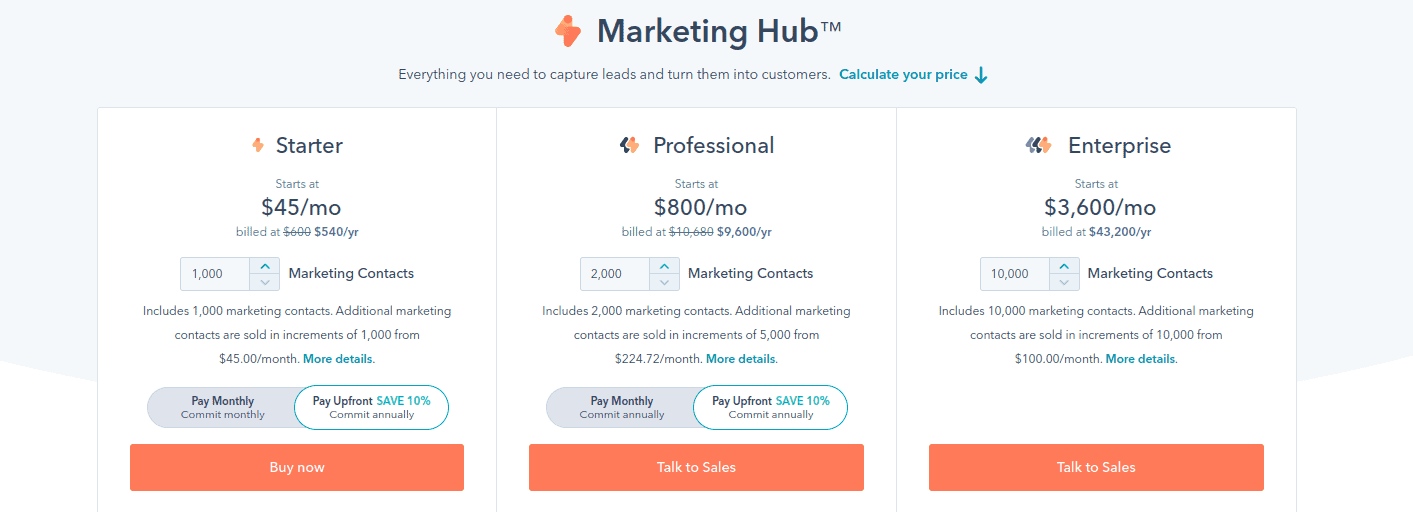

HubSpot has four pricing plans – Free, Starter, Professional, and Enterprise

- Free: No credit card is required to access all free tools

- Starter: $45/month, billed annually at $216 with up to 1,000 marketing contacts

- Professional: $800/month, billed annually, up to 2,000 marketing contacts

- Enterprise: $3600/month, billed annually at $43,200, up to 10,000 marketing contacts

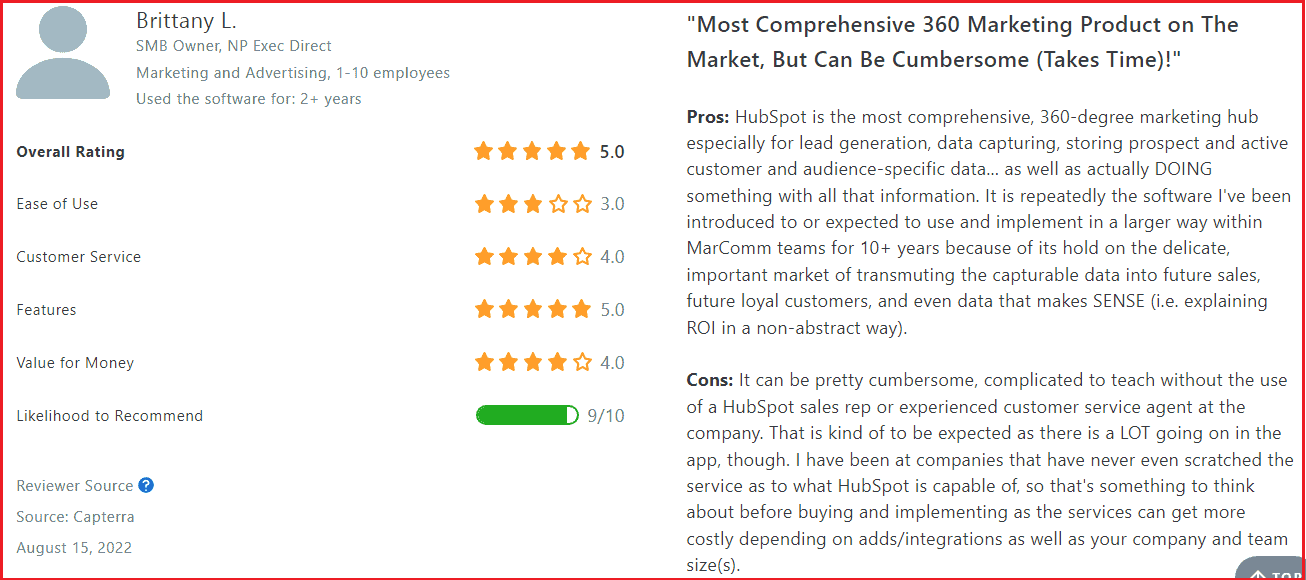

Pros

- All-in-one marketing software

- Responsive customer support

- Measures and track your results of campaign performance

- Easy to use, even for beginners

- Integrated CRM

- Robust integrations

Cons

- Expensive CRM software

- Inflexible contract

- Additional charges for additional technical support

- There is no A/B testing on lower packages (Pro and Starter)

- Reporting is not available on lower packages

Review

Read also: Is HubSpot Worth It? In-depth Review for Small Businesses

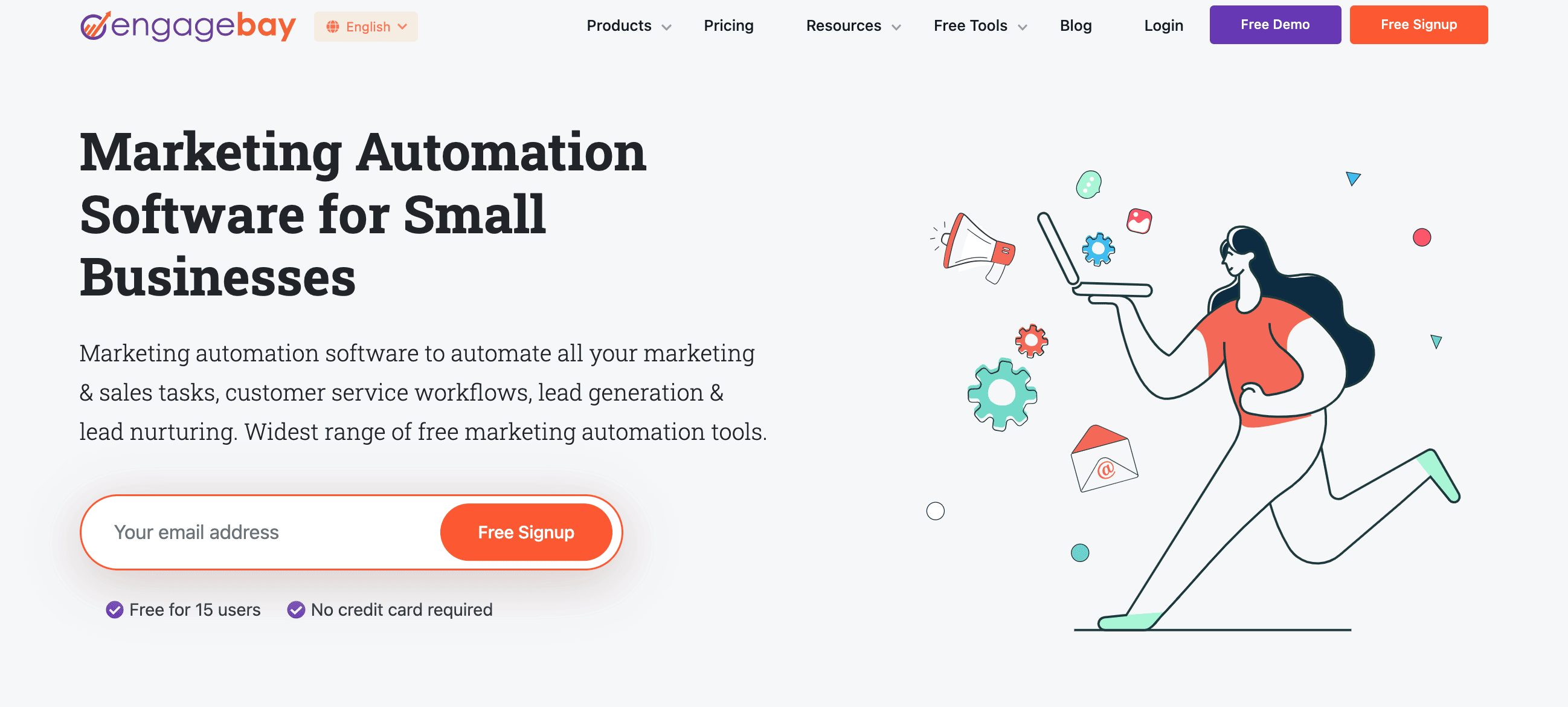

#2.EngageBay

EngageBay is the second on our list, and this is because it is open to businesses of all sizes. Being available to businesses of all sizes means that the size of your company does not matter. EngageBay can handle it. The software is also an all-in-one automation tool that can streamline all your marketing, sales, and support efforts on a single platform.

How nice would it be to be able to send different messages to your clients based on their stage in the sales funnel? With EngageBay’s predictive lead scoring, you can efficiently score leads and send personalized automated messaging based on where your leads are on their customer journey.

EngageBay’s live chat feature allows you to send quick and personalized responses to website visitors, reducing response time and increasing customer satisfaction. Additionally, you can increase team productivity by automating your outbound call using the auto-dialer software.

As a financial advisor, you don’t have to allow deals to slip through the cracks with EngageBay’s contact management tool, which will enable you to manage contacts, deals, & tasks so you can stay organized and close more sales with clients.

It doesn’t end there. EngageBay’s CRM tool lets you have all customer data and real-time updates across teams on a centralized platform for effective communication and relationship building. Additionally, explore our email templates to enhance your email campaigns and boost engagement rates.

Also, with the website tracking feature, you are privy to your visitors’ demographics, such as location, time spent on site, age, etc. This helps with client segmentation for dynamic nurturing.

Other features on EngageBay include:

- Email template builder

- Milestone tracking

- Company management

- Social media post-scheduling

- Advanced reporting and analytics

- SMS broadcast

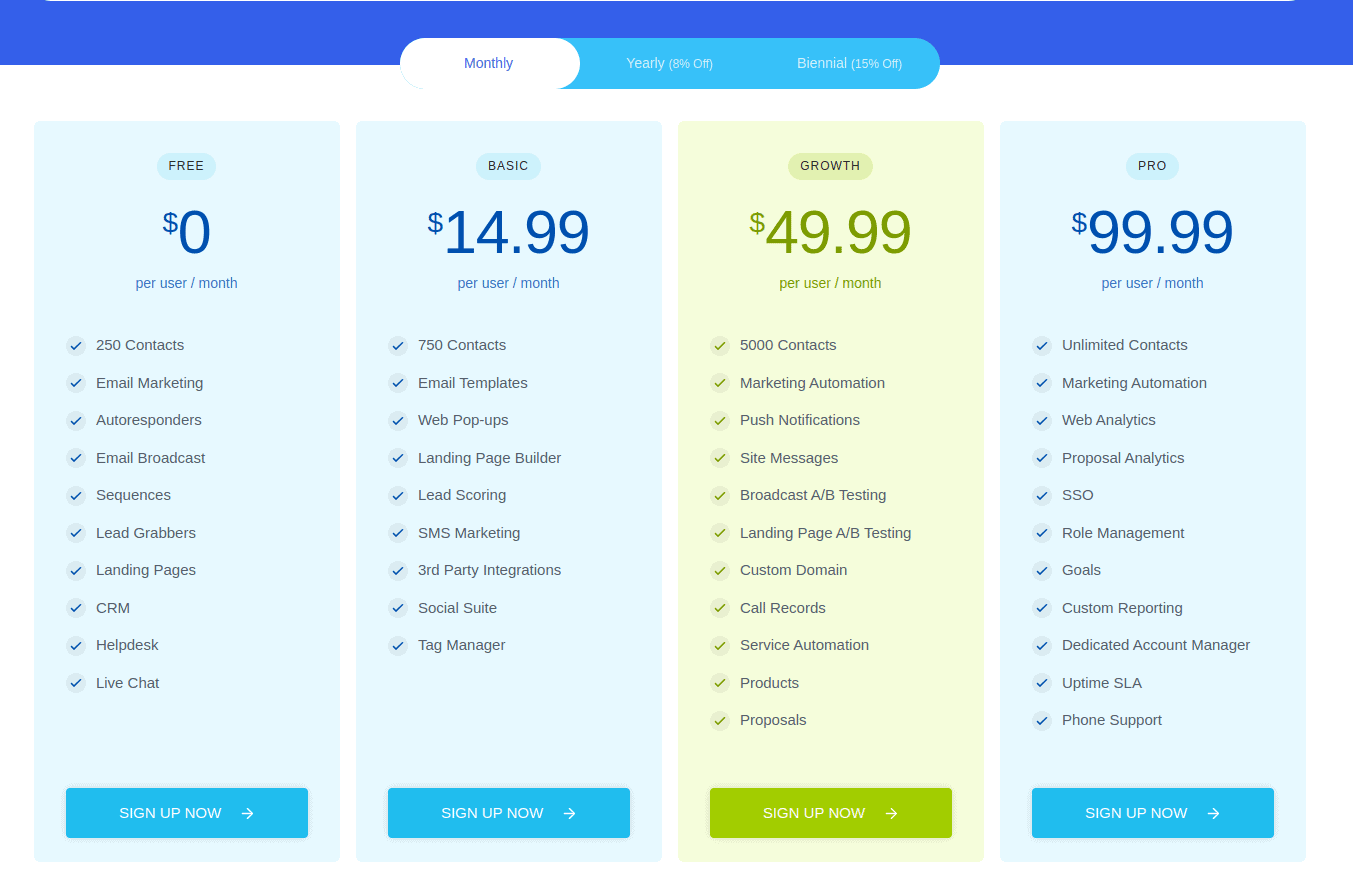

Pricing

- Free: No credit card is required; 250 contacts

- Basic: $14.99/month, 750 contacts

- Growth: $49.99/month, 5000 contacts

- Pro: $99.99/month, unlimited contacts

You save 8% on all plans when you subscribe to the annual payments and 15% when you subscribe to the biennial payments.

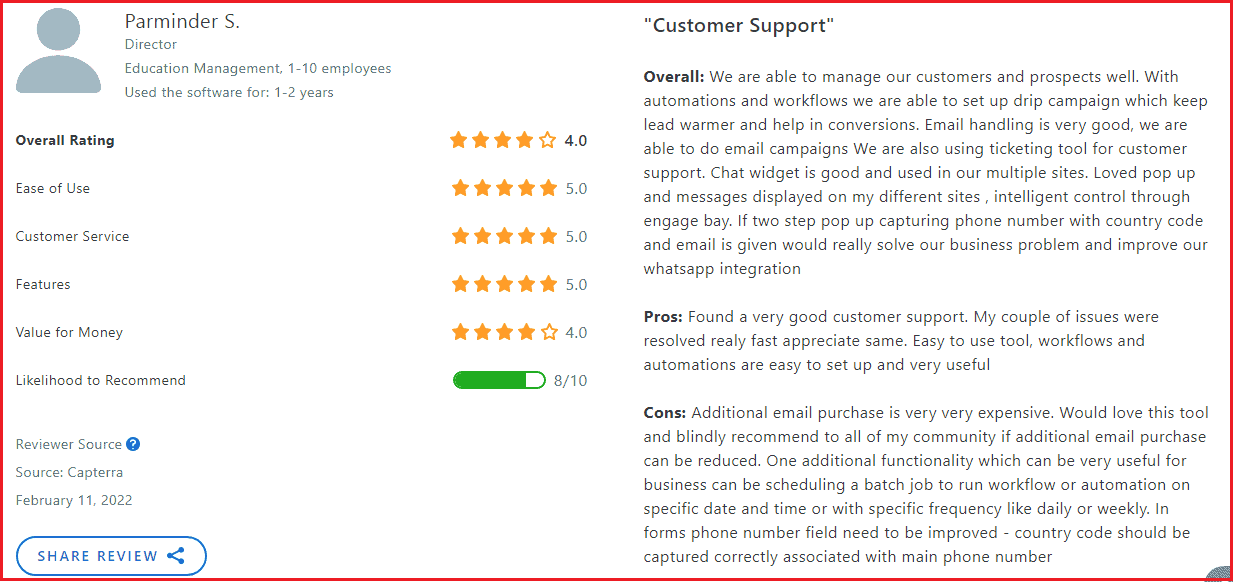

Pros

- All-in-one automation software for sales and marketing

- Designed for SMBs

- Free CRM, helpdesk, and live chat support

- SMB-friendly pricing

- Easy to use and dependable

- Saves time and improves efficiency

Cons

- Landing page templates are limited at the moment

- Limited integrations

Review

Read also: 17 Cool Free Marketing Automation Platforms Reviewed

#3. MailChimp

The third software on our list, MailChimp, has many features. First, MailChimp’s campaign manager is excellent for lead generation. It allows you to build campaigns on multiple platforms and manage them from a unified platform. Additionally, the MailChimp campaign manager will enable you to track success based on your goals for each campaign.

With its webhook integration, you can manage internal notifications, support tickets, to-do lists, and more by integrating into Campaign Manager for a seamless experience. Additionally, you can automatically update your accounting software when invoices are paid, cancel a paid subscription, or unsubscribe a client from a subscription.

That’s not all. MailChimp’s free website and landing page tool allows you to grow your finance brand, attract more leads, and enhance your marketing efforts at no extra cost. This is cool if you run a small finance advisory firm or a solopreneur.

Its Customer Journey Builder also allows you to scale your automation efforts while maintaining relevant customer interactions based on their browsing behavior.

Other features you’ll find on MailChimp include:

- Customized email design

- Campaign automation and journey creation

- Audience segmentation and behavioral targeting

- Signup forms, landing pages, and websites

- Send time optimization

- Pre-built email templates

Pricing

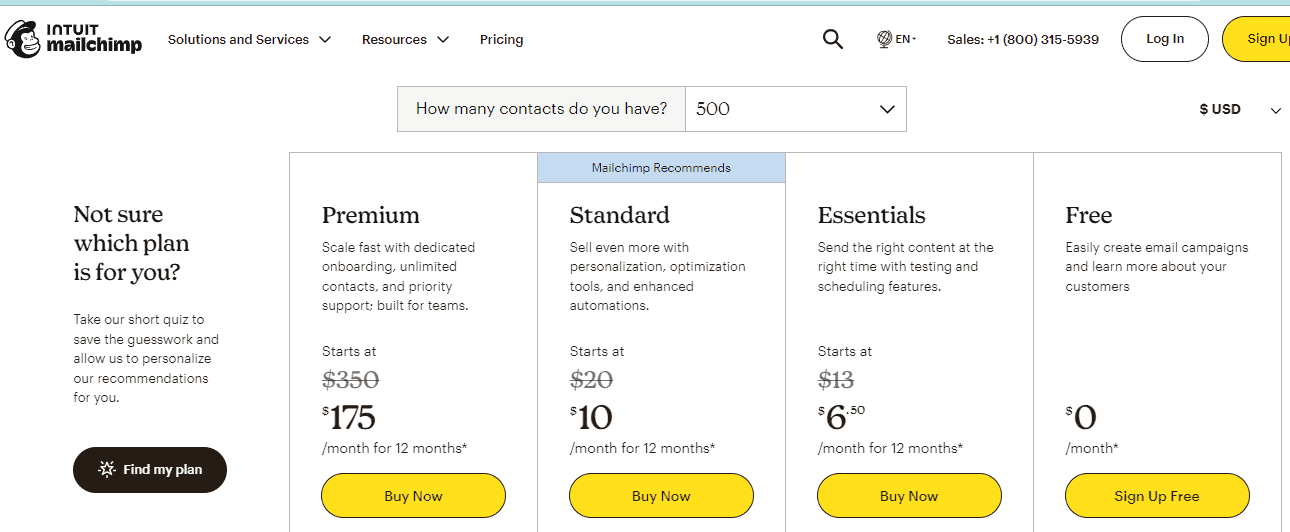

MailChimp has four pricing plans – Free, Essentials, Standard, and Premium.

- Free: Access to automation is allowed, but with limited features

- Essentials: $6/month, billed annually, 500 contacts

- Standard: $10/month, billed annually, 500 contacts

- Premium: $175/month, billed annually, for a custom plan

Pros

- Beginner friendly

- Ability to segment contacts

- Import contacts from other platforms such as Salesforce, Square Space

- Multivariate and A/B testing

- Built-in conversion tools to convert leads to sales

Cons

- Limited email capability with every plan

- Limited access to full features with the free plan

- Not cost-effective if your finance advisory caters to large contact

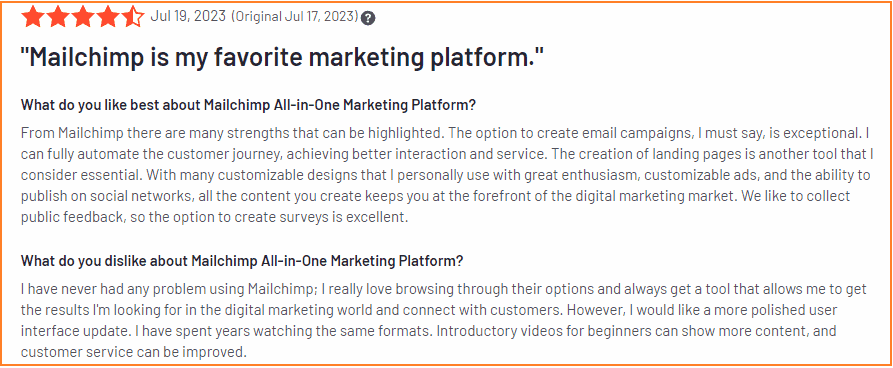

Review

Read also: 17 Mailchimp Alternatives With Pricing, Comparison Tables

#4. Klaviyo

Fourth on this list is Klaviyo. Klaviyo is loved for its advanced segmentation and automation capabilities. As a financial advisor, you can set up drip campaigns and automated sequences for new or existing customers. For example, you can create onboarding sequences for new clients or welcome emails, nurture leads with personalized content, or send automated reminders for important meetings or financial milestone updates.

Additionally, you can reach clients offline with time-sensitive updates and appointment reminders with Klaviyo’s SMS marketing tool.

Klaviyo integrates with CRM tools, allowing you to centralize client data and automate communication based on client interactions and milestones.

other features you’ll find on Klaviyo include:

- Real-time, marketer-friendly segmentation

- Detailed customer profiles

- Flexible data storage and retention

- Built-in compliance and deliverability

- Automated A/B testing

- Drag-and-drop automation builder

- Precise multi-channel attribution

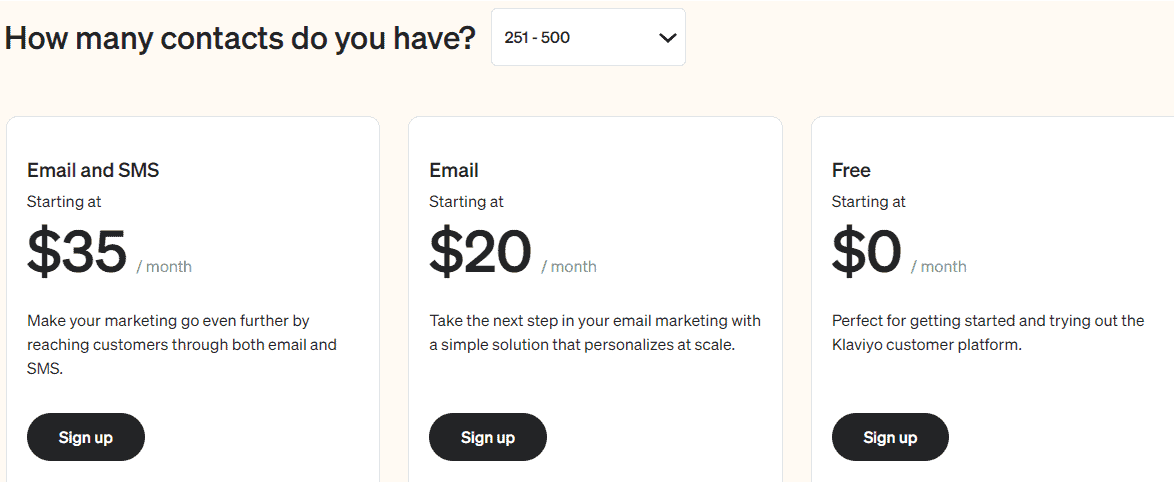

Pricing

- Free: Access to 50 monthly SMS & MMS credit, and 60 emails

- Email: starting at $20/month, up to 500 contacts

- Email & SMS: starting at 35/month, up to 500 contacts

Pros

- Easy-to-use interface

- Email scheduler

- In-depth analytics

- Customer segmentation

- Customer service

Cons

- The pricing structure is dependent on your email list

- Steep learning curve

- No in-built landing page builder

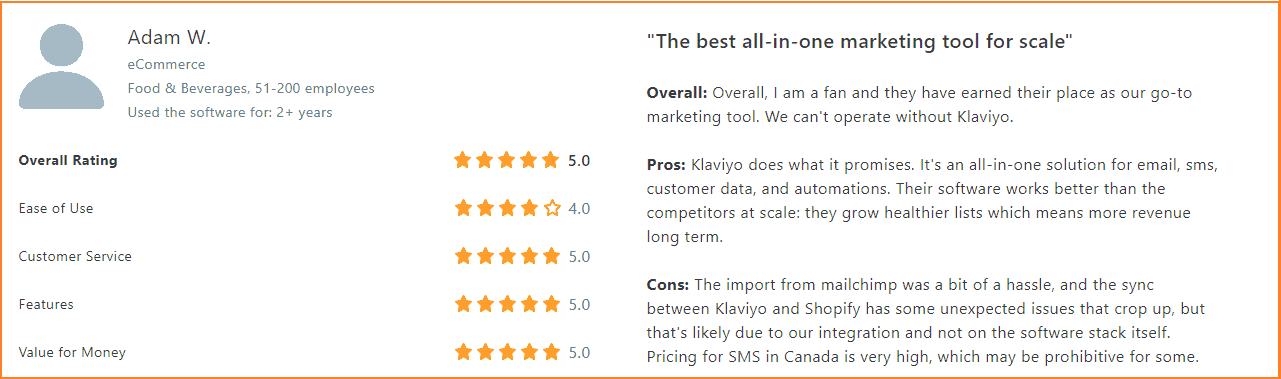

Review

Read also: What is Pardot? An In-depth Guide for Beginners

#5. SocialPilot

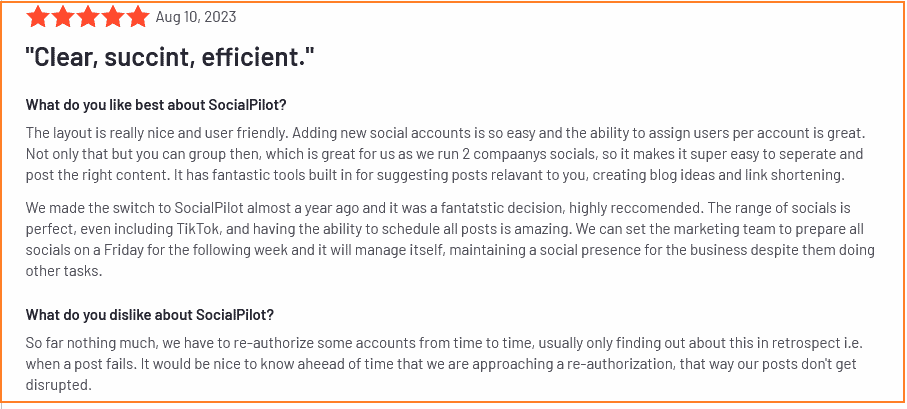

Fifth on our list, SocialPilot is a cloud-based social media management that helps with content creation, curation, scheduling, and overall management of social media brands.

With SocialPilot, you can schedule when you want to upload created content on any or all of your media platforms. You can add to the queue, schedule for a later time, or choose to publish immediately at your selected time.

The software can help you reach a broader audience as a financial advisor on all your media platforms. It can automate most time-consuming tasks, such as scheduling posts, managing hashtags, and tracking analytics.

SocialPilot can also help you measure the ROI of your social media marketing campaign. With features such as social media analytics, ads, and campaign optimization, you do not need to be scared of the hectic work.

Other features you’ll find on SocialPilot include:

- Campaign planning

- Social media Ads

- Social media publishing

- Social media analytics

- Campaign optimization

- Social engagement

- Browser extension

- Advance post scheduler

- URL shortening integration

Pricing

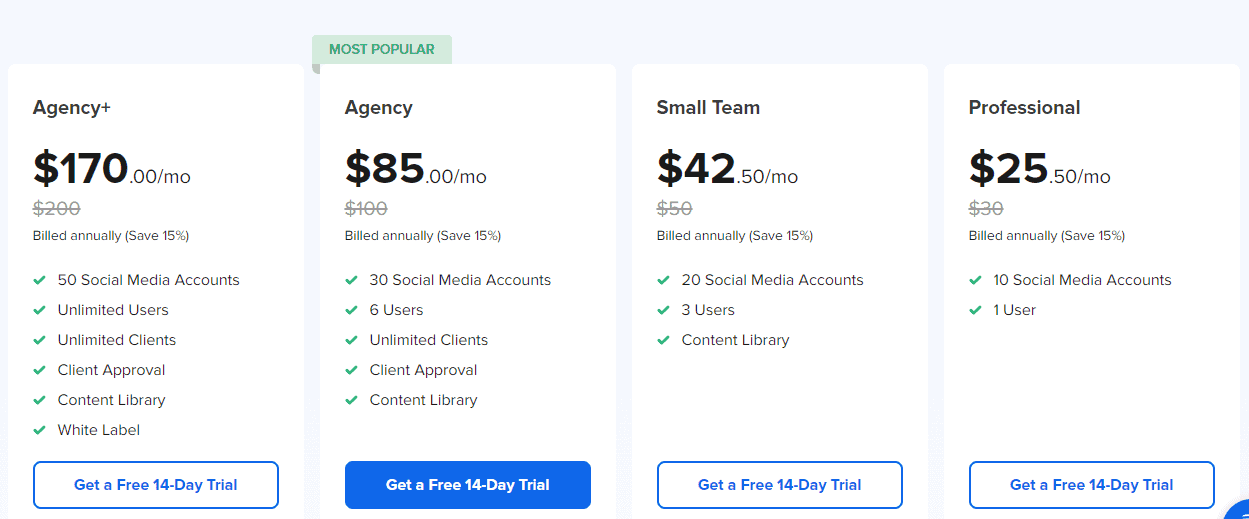

Social Pilot offers four pricing plans: Professional, Small team, Agency, and Agency+.

- Professional: $25/month, billed annually, 10 social media accounts

- Small team: $42.50/month, billed annually, 20 social media accounts

- Agency: $85/month, billed annually, 30 social media accounts

- Agency+: $170/month, billed annually, 50 social media accounts with unlimited users and clients

You save 15% on all plans when you subscribe annually.

Pros

- Very affordable

- It supports all major social media platforms

- Advanced analytics

- Reseller options

- Content curation

- Bulk scheduling with images

Cons

- Lack of Instagram analytics

- Absence of a completely free plan

Review

👉 Optimize your marketing efforts with our email templates designed for efficiency and impact.

Read also: AWeber vs Mailchimp and Other Email Tools

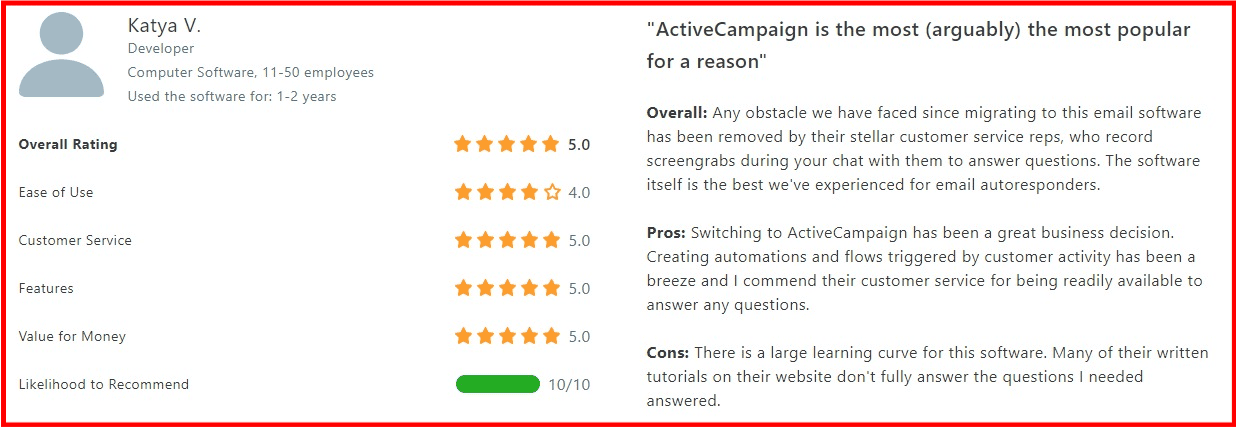

#6. ActiveCampaign

ActiveCampaign’s scheduling tool lets your finance clients and prospects book meetings or consultations through your website.

Additionally, you can set up automated sequences to nurture leads and give market updates, investment, and financial newsletters with its automated workflows. This is important to nurture leads, build customer trust, and bring them up in the sales pipeline.

For instance, when a new client signs up for your webinar or newsletter from your lead capture forms on your website, sending emails with relevant financial updates is an excellent way to showcase expertise and increase the chances of closing the client.

Also, with ActiveCampaign, you can create custom audience segments based on client behavior and interests, allowing you to deliver highly targeted ads on social spaces like Facebook and re-engage existing leads or clients.

Other features available to you include:

- Access to 870+ integrations

- Client segmentation

- Lead scoring

- Automations map

- Split automation

- Drag and drop email designer

- Landing pages

- A/B testing

- Customer relationship management (CRM)

Pricing

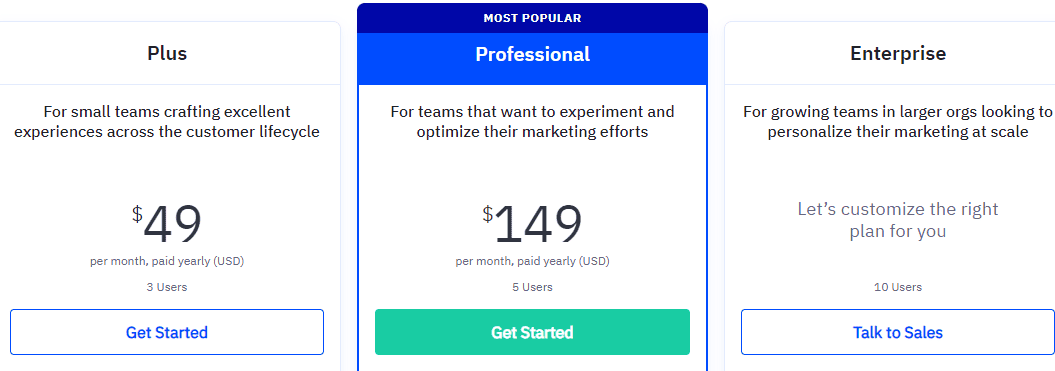

With ActiveCampaign, you can access four pricing plans–Lite, Plus, Professional, and Enterprise.

- Lite: Free, but it has minimal access to all features

- Plus: $49/month, billed annually

- Professional: $149/month, billed annually

- Enterprise: Customized plan for marketing of large-scale

Pros

- ActiveCampaign has a CRM platform

- Allows you to split test automation workflows

- Advanced automation capabilities, including customizable triggers

- High deliverability

- Free Migration

- Powerful automation

- Flexible integration

Cons

- Customer relationship management is not included in the Lite plan

- Steep learning curve

- A/B testing is not in the Lite plan

- Limitations on the number of conditions you can add to a segment

- The free trial is short

- Pricing is complex

Review

#7. GetResponse

Want to improve customer service? With GetResponse, you can automatically send follow-up emails after client interactions or inquiries, ensuring timely responses and improved customer service, or integrate with other survey tools like Google Forms or Survey Monkey.

Integrate GetResponse with CRM systems, financial planning tools, or other software to streamline client management and communication. You can also reduce time spent on administrative work by automating tasks such as financial reports or compliance documents.

GetResponse’s robust integration allows you to easily integrate into other financial tools necessary for a seamless experience, such as Google Analytics or Tableau for advanced reporting and analytics or webinar hosting platforms Zoom and WebEx.

Other features on GetResponse include:

- Sales funnel and conversion funnel

- Landing pages and website builder

- Built-in email templates and editor

- Data management and deliverability

- Data segmentation

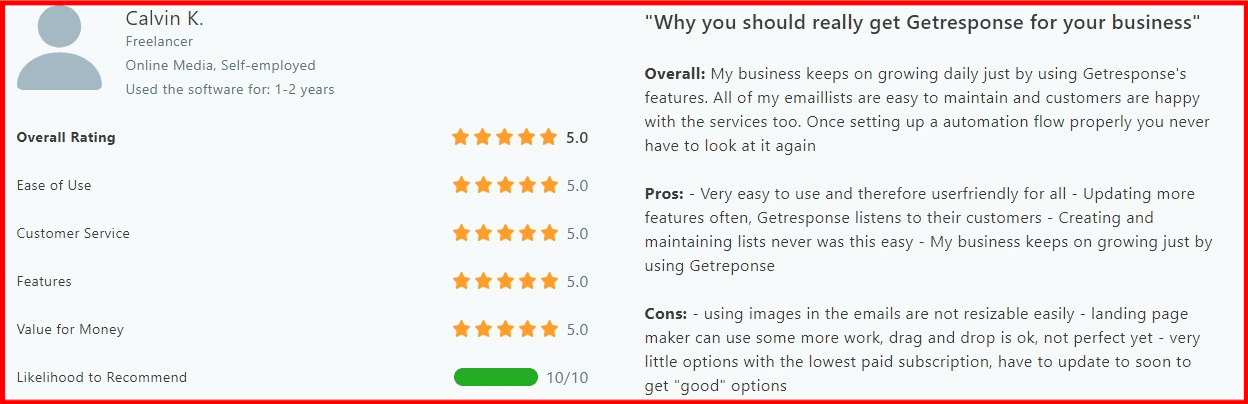

Pricing

As a financial advisor, four pricing plans are available for your marketing needs on GetResponse.

- Free: No credit card required. Limited access to full features.

- Email marketing: $13.2/month, billed annually, up to 1,000 subscribers

- Marketing automation: $41.1/month, billed annually, up to 1,000 subscribers for email

- Max: Custom plan at $999/month, billed annually

Pros

- Affordable compared to other email marketing automation tools

- Conversion funnel

- Google Analytics can be integrated with platforms like Facebook and WordPress

- Live chat for websites

- Email list automation

- Easy-to-use drag-and-drop tools that help simplify email creation

Cons

- No refund on the annual plan

- You get phone support only when you buy a Max plan

- Basic automation on some plans

- A/B splitting is easy, but analytics is a bit slow and confusing

- No free landing page template is provided

Review

Read also: 15 of the Best GetResponse Alternatives (Features, Pricing)

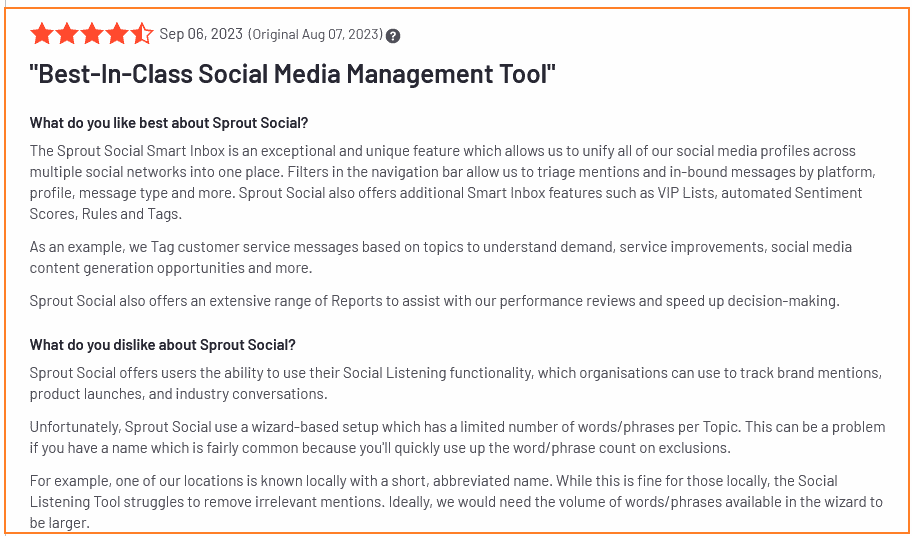

#8. Sprout Social

Sprout Social is a social media marketing automation software that you can use to streamline your media publishing and scheduling. The streamlining helps you to make decisions based on the obtained data with analytics tools.

With Sprout Social, you can identify market shifts, monitor your brand’s health, and track competitors to stay ahead of them. The software also integrates with tools like Salesforce to extract real business value.

People who use Sprout Social do so because the automation reduces the time spent on social marketing. You can also incorporate it to reach a wider audience with social media content. Its features allow you to monitor your media platform, track negatives, and track brand sentiments.

As a financial advisor, you can also collaborate with your team on social media marketing.

Other features you’ll find on Sprout Social include:

- Account management

- Reporting analytics

- Competitor analysis

- Campaign success analytics

- Lead generation

- Automated routing and prioritization

- Broad channel coverage

- Noise and spam filtering

- Real-time filtering

Pricing

Pricing

There are four pricing packages on Sprout Social

- Standard: $249/month, 5 social profiles

- Professional: $399/month, unlimited social profiles

- Advanced: $499/month, unlimited social profiles

- Enterprise: custom plan with unlimited social profiles and premier success consulting services

Pros

- A wide range of social media outlets, including YouTube and Google Analytics

- Intuitive and neat user interface

- Ability to schedule content

- Exceptional reporting capabilities

- Useful app integrations

- Easy-to-use

- Social media analytics

Cons

- Technical support is low

- Steep learning curve

- Limited scheduling and reporting features

- Limited core social media publishing options

Reviews

Read also: Wealth Management Marketing Strategies for a Brighter 2024

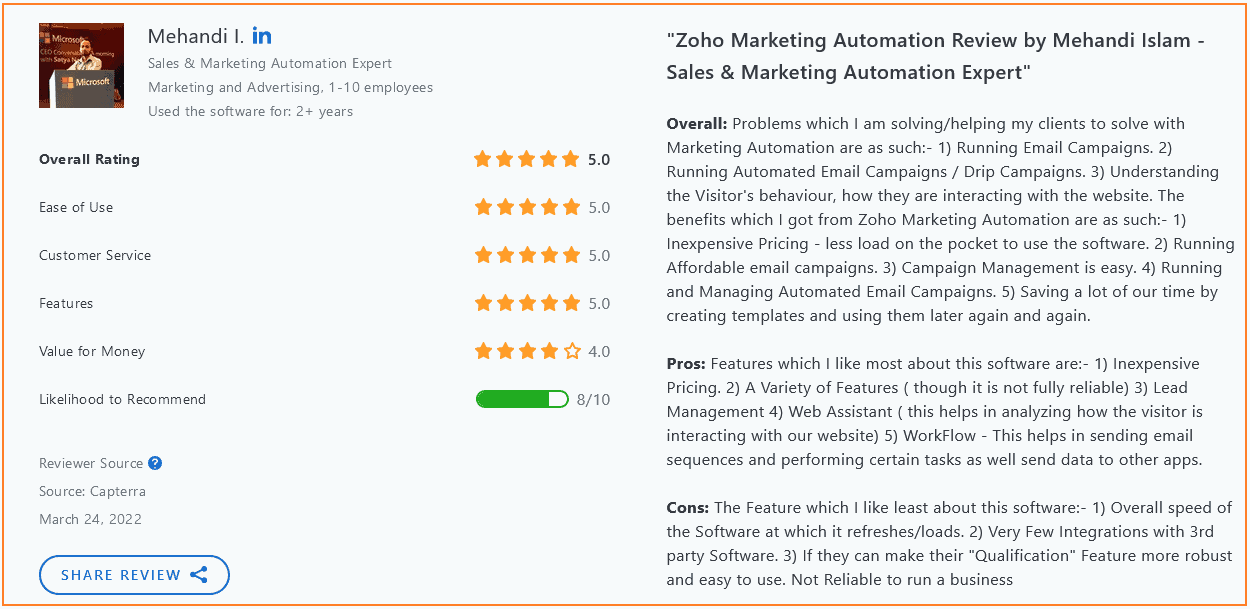

#9. Zoho Analytics

The Ninth-best marketing automation software on our list, Zoho Analytics, is an intelligent analytic platform that helps collect, store, visualize, and interpret data, making it an excellent tool for finance advisors.

With its interactive dashboards that provide real-time insights into data, you can set controls while collaborating with teams to ensure data security.

One of the best benefits you’d enjoy as a finance advisor using Zoho is its ability to analyze your various marketing channels or customer segments to see what is working and what needs improvement.

As a marketing automation tool, Zoho Analytics can automate your business marketing tasks, such as email marketing and social media nurturing. It is an affordable and user-friendly automation platform.

Zoho Analytics’s Customer journey feature helps you to create an incredible journey for your customers by sending them personalized messages. It can also provide insight into your customer base, such as spending habits.

Other features of Zoho marketing automation include:

- Lead generation and nurturing

- Behavioural marketing

- Lead qualification

- Web analytics

- Multi-channel marketing

- Customer journeys

- Marketing planner

Pricing

Three pricing tiers are available for you to choose from: Standard, Professional, and Enterprise.

Standard: $14/month, billed annually, 10 users

Professional: $22/month, billed annually, 15 users with complete contact management

Enterprise: $44/month, billed annually, customizable metrics

Pros

- Valuable CRM with the free plan

- Web Assistant for analyzing how visitors interact with your website

- Affordable cost

- Good variety of features

- Lead Management

- Workflow that helps you in sending email sequences

- Email templates

- User-friendly

Cons

- Very few integrations

- Poor customer support

- Takes time

- Steep learning curve

Review

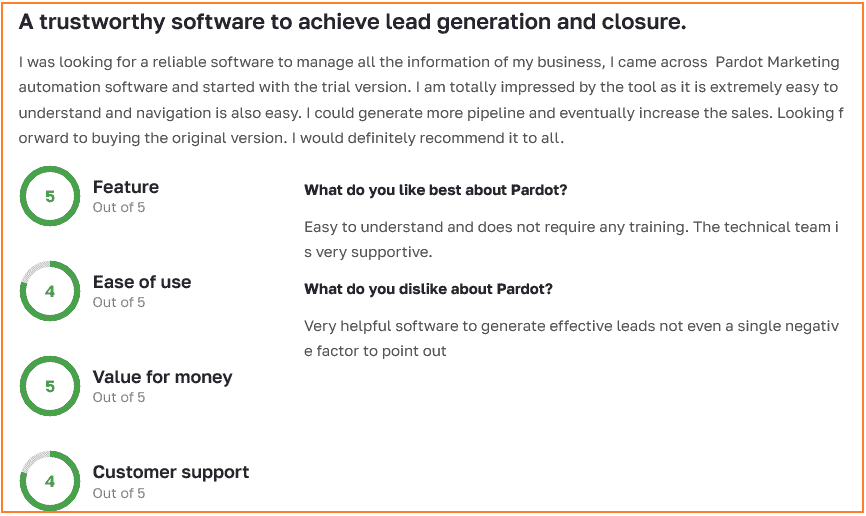

#10. Pardot

Pardot, the tenth automation platform on our list, is a cloud-based platform that integrates with Salesforce CRM, making tracking and managing your generated leads easy. The software focuses on lead scoring, nurturing, and generation throughout the sales funnel.

Being built on the Salesforce platform, Pardot provides an extensive integration with Salesforce CRM. Allowing you to have a unified view of your marketing and sales data, real-time updates on prospects, and customer data syncing.

Pardot Analytics Studio allows you to gain in-depth insight into the customer journey, from lead generation to conversion. This way, your marketing campaign’s performance can be analyzed for improvement and better results.

Other features include:

- Multi-touchpoint automaton builder

- Landing pages and forms

- Search tracking and optimization

- Journey Builder

- Lead management

- Analytics and attribution

- ROI reporting

- CRM integration

Pricing

Salesforce Pardot has four pricing plans with a $1,250 starting price.

- Default: $1,250/month

- Growth: $1,250+/month

- Plus: $2,500+/month

- Advanced: $4,000+/month

Pros

- Integration with leading CRM

- Customer journey builder

- Automation capabilities

- Easy-to-use

- In-depth prospect tracking

- Easily customizable

Cons

- The high price of the plan

- Low reporting feature on marketing activities

- Social media support is weak

- A/B testing and API access is only available to PRO subscribers

Review

Read also: Pardot Pricing Explained Without Bias [+ User Reviews]

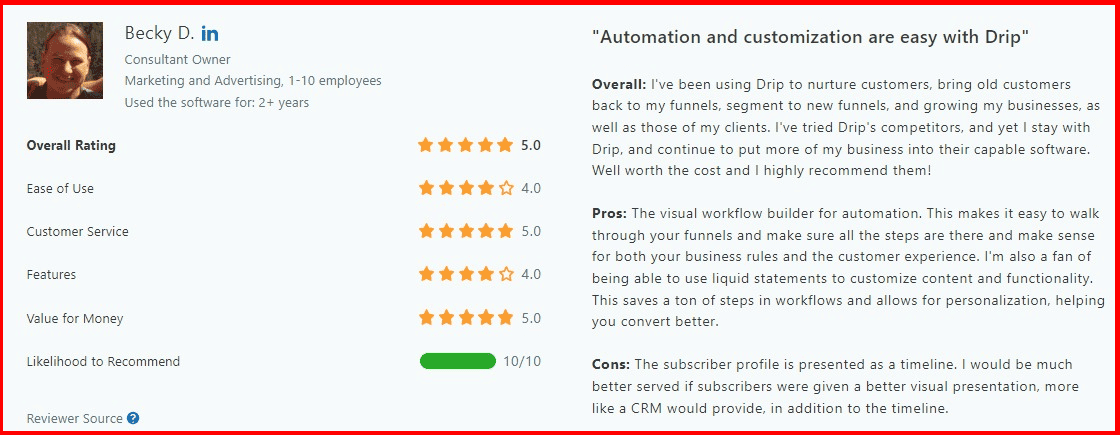

#11. Drip

The eleventh-best tool on our list is Drip. Finance advisors can use it to automate email campaigns, saving time and the stress of doing it manually.

The software has many features, such as real-time reporting, integration with other tools, and customer segmentations. All of these features are specially designed to help your relationship with customers.

You create and send drip sequences for new clients hat guides them through onboarding and other relevant information.

Drip’s primary advantage over other marketing automation platforms is its affordability and ease of use.

Other features include:

- Real-time alerts

- Lead management

- Basic organized workflow

- Social marketing

- Segmentation

Pricing

Drip has just one pricing plan starting at $39/month for up to 2,500 people with unlimited sending of email and support. You can start for free, but it lasts 14 days.

Pros

- Effective lead nurturing

- Upselling and cross-selling

- Flexible pricing

Cons

- Significant up-front time investment

- Automation rarely works perfectly

- Limited integration

Review

#12. SharpSpring

SharpSpring, acquired by Constant Contact, is another excellent option in lead management software.

Lead management starts with lead generation, and as a financial advisor, you need this software to attract clients and customers to whom you will dispense your services. SharpSpring will help you generate leads by creating and managing landing pages and running email marketing campaigns.

Financial advisors also need to manage the list of clients that require their expertise, and SharpSpring provides the right platform to help you nurture and drive your generated leads. Through nurturing and managing your customers, you will be able to retain them.

With SharpSpring, you can track your ROI, which will further help you improve your future engagement with clients and your services as a financial advisor.

Other features available include:

- CRM

- Email integration

- Lead management

- Reporting analytics

- List-building tools

- SMS marketing

Pricing

There is just one pricing plan available starting at $449/month.

Pros

- User-friendly

- Ideal for agencies

- Month-to-month contracts

- Cost-effective

Cons

- Limited features

- Reporting capability is not outstanding

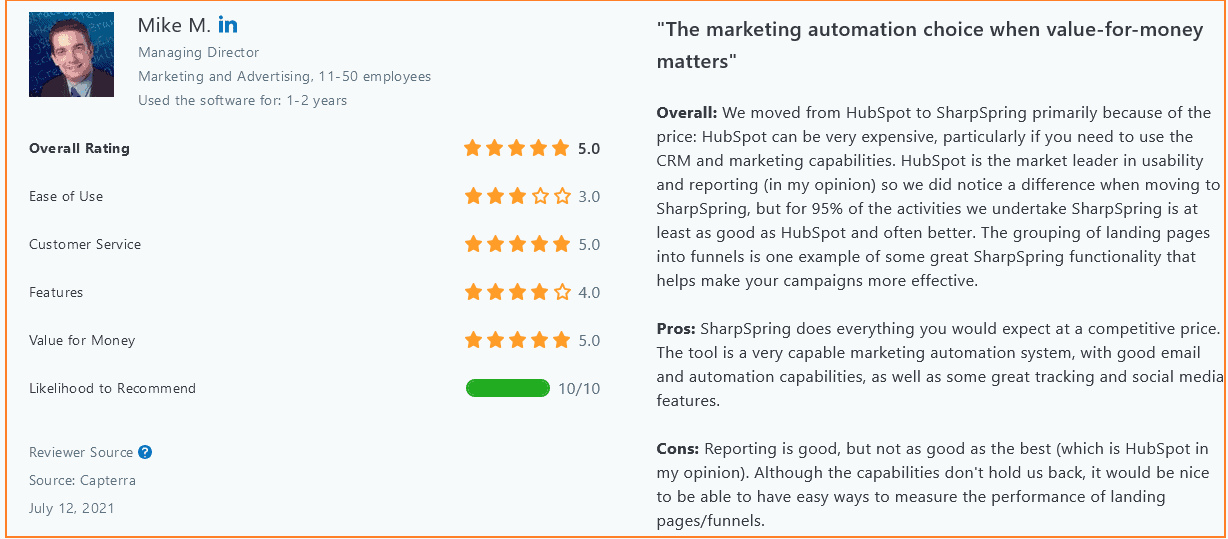

Review

Read also: 9 SharpSpring Alternatives For SMBs [With Pricing, Features]

#13. Ontraport

Ontraport is another automation software on this list focusing on managing customer relationships. It is a sales and marketing platform, and it has a good number of features that have been incorporated into the software.

Ontraport helps financial advisors close deals by providing them with tools that will help them track opportunities, manage their contacts, and score more leads. With its Affiliate Management tool, you can manage your affiliate and referral program (if you have one), track commission, and close more clients.

With the features of Ontraport, you are enabled to track updates of your multiple interactions with clients.

Other features available on Ontraport include:

- Sales and CRM

- A/B Testing

- Mobile app

- Event scheduling

- Data quality management

- Segmentation

- Campaign reporting

Pricing

There are four planning plans available, including:

- Basic: Starting at $24/month, email and text message automation

- Plus: Starting at $83/month, advanced CRM, email and text message automation

- Pro: Starting at $124/month, deep customization, marketing tracking and testing

- Enterprise: Starting at $249/month, unlimited access to all features of Ontraport

Pros

- Affordable price

- Great community and customer support

- Unified system

- Good for SMBs

- Choreographed cross-channel experience

- Auto-organization

Cons

- Steep learning curve

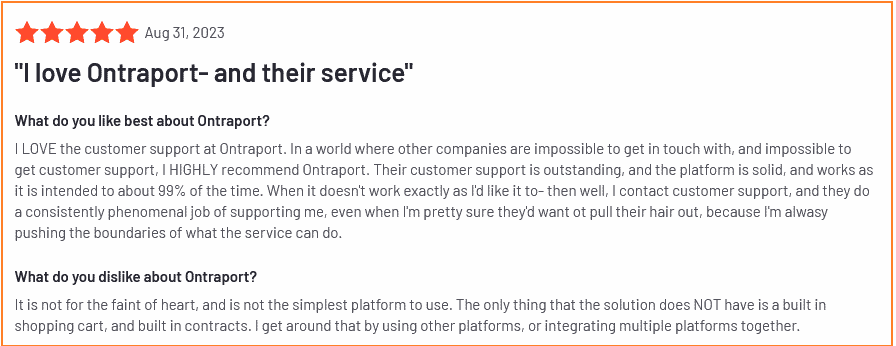

Review

#14. Marketo Engage

The last marketing automation tool on our list, Marketo Engage, is a powerful marketing automation software. It is known as the world’s largest marketing automation platform.

Being the world’s largest automation software means it is packed with tools to help you as a financial advisor. It lets you put your services out to the public and streamline them to your target audience.

With Marketo Engage, you can segment your generated leads for proper management and nurturing. Giving advice and tips to clients and customers is based on the information obtained from them through analytics, and you can do that perfectly with the software’s ability to manage leads.

Lastly, people who use the tool do so to generate leads, make more sales, and manage campaigns. As a financial advisor, you can use the software to get customers who benefit from you. You can also retain your customers through the software’s management feature.

Some other features include:

- Consumer engagement marketing

- Real-time personalization

- Lead Generation

- Measure and Optimize ROI

- Campaign management

Pricing

There are four pricing plans available, and each is custom-priced. You’ll have to get in touch with the sales team.

- Growth: Custom price, core email marketing

- Select: Custom price, essential marketing automation, and measurement

- Prime: Custom price, lead-and-account-based marketing

- Ultimate: Custom price, powerful marketing tool with premium attribution

Pros

- Easy and intuitive to use

- Easy to setup

- Great Salesforce Integration

- Customer support and community

Cons

- Poor landing page & form builder

- Reports and analytics take time

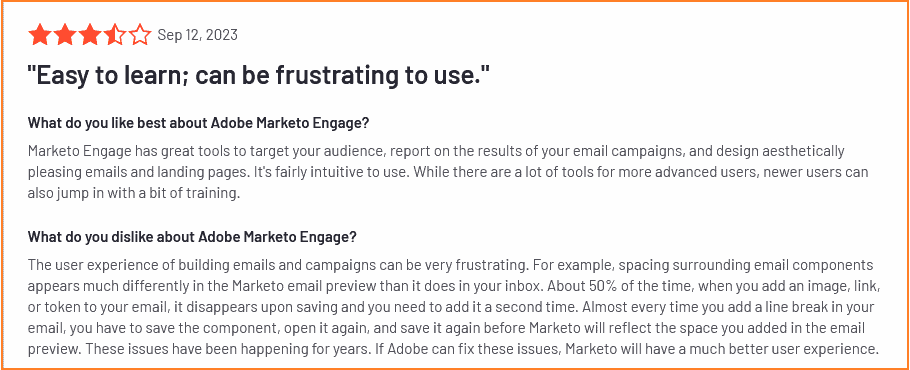

Reviews

Read also: Marketing Automation For Manufacturing: Beginner’s Guide

Best Practices in Marketing Automating for Financial Advisors

These practices are designed to help enhance your marketing effort while ensuring you stay within the industry regulations in delivering top-notch services to your clients. Here are some of the best practices for automating your marketing processes:

1. A clear buyer journey map is key

Having a clear buyer journey map would be best to benefit from your marketing automation efforts. This begins with segmenting your audience, understanding their points, and creating content for the stages in the sales funnel. Here’s a breakdown of the steps involved.

Identify your ideal clients

Different financial institutions cater to different financial needs. Do you offer investment advisory, retirement packages, or business tax advisory?

A clear picture of your services will help you identify your ideal clients. Consider factors like income level, age, and financial goals to streamline your search further.

For example, who falls better into your ideal client if you offer retirement packages between Client A and Client B?

Client A: Samantha, a 25-year-old female, fresh out of college, earns less than $1000/month and is looking to diversify her income.

Client B: Brenda, a 35-year-old female executive at a construction firm, plans to retire in 10 years.

Your guess is as good as mine. Brenda is your ideal client, and her chances of opting in for your services are 100% higher than Samantha’s conversion. Loads of businesses allow their marketing efforts to slip through the cracks by targeting the wrong audience.

Identify key platforms for client interaction

Now that you’ve clearly understood your core services and ideal clients, it’s time to streamline the platforms you want to use to draw them in and the platforms they interact with your brand the most.

Continuing with our client profile above, the chances of finding Brenda on Linkedin are higher than on Instagram or TikTok.

So, you want to ensure you increase the chances of finding your ideal clients by determining key platforms for marketing.

Additionally, identify the key touchpoints (the key areas clients or prospects interact with your brand most). It could be emails, website visits, or social media.

Map out the buyer journey and create content for each stage

The typical stages for a financial advisor include Awareness, Interest, Decision, and Post-purchase (to increase chances of future retention).

For example:

- The awareness stage can include blog posts, webinars, and detailed checklists or use cases.

- The decision stage can include one-on-one consultation, client testimonials, and personalized financial plans.

- The Post-purchase stage can include referral programs and portfolio updates.

You can then use marketing automation to send automated drip and social media campaigns and then use lead scoring to identify prospects ready to go up each stage or be followed up by the sales and marketing team.

Fortunately, you can do all this on a single automation platform like EngageBay.

👉 Boost your email marketing campaigns with EngageBay’s customizable email templates tailored for engagement and success.

2. Evaluate marketing automation performance and refine strategy

To effectively evaluate your marketing strategy, the following steps are crucial:

Understand your marketing goals

The first step to evaluating your marketing performance is clearly understanding your goals. That way, you know if the marketing automation strategy has been effective. Your goal could, for instance, be to achieve one or more of the following:

- Reduce customer cost acquisition (CAC)

- Generate more qualified leads

- Increase conversion rate

- Boost client retention

- Increase customer lifetime value (CLV)

- Improve customer support

In addition to being able to better measure your campaign performance by clearly defining your goals, this step is also essential to know the marketing automation strategy that helps you achieve the goal. Suppose your goal is to improve customer support; an automation feature like Live Chat should be considered. Conversely, omnichannel marketing is a good fit if you want to generate more leads.

Set KPIs to track each goal

After defining your marketing goal and identifying the best automation strategy, next is to set KPIs (key performance indicators) that let you track your progress in achieving the goal.

Using the examples above, if your goal were to increase customer lifetime value, the metrics you’d be looking out for would include the following:

Average customer lifespan

This metric measures the average duration customers spend with you. It is calculated by dividing the total number of clients by the total sum of customer lifespan. If your financial advisory runs on a subscription-based model, you can also determine your ACL by checking the customer churn rate.

Average revenue per customer

This is calculated by dividing total revenue by the total number of customers per segment. This metric lets you know how much you generate from each client over a specific period and is crucial in determining your customer’s lifetime value.

Net promoters score

A high net promoters score (above 70) means you have more promoters (customers willing to tell customers about your brand) than detractors (clients who don’t find your service satisfactory.) This metric is essential to track if your goal is to improve customer lifetime value because it is a key indicator of how satisfied clients are with your financial service.

The more satisfied clients are, the higher their chances of becoming life-long customers.

Conversely, if your goal is to generate more leads, you’d be looking at metrics like Landing page conversion rate, click-through rate, time-to-conversion, and total lead generated rates.

Finally, after analyzing the performance, refine, weed out, and reuse what works. It is good practice to do this periodically because marketing strategies are a moving train, so you must check to be sure you are constantly on board.

3. Integration of marketing automation tool with your CRM

The purpose of automating tasks in marketing is to make your operation easier and more efficient. With CRM integration, you get all your customer data on a single platform for a comprehensive view. This way, all teams have real-time updates on their client interactions.

Suppose the sales team schedules a call with a client who wants a one-on-one consultation to know your financial packages, and the customer support team wants to follow up. It’s easy for them to get the relevant information they need on the CRM.

So, a CRM integration enables you to have a seamless experience and track interactions as prospects go through the different sales funnels and teams.

Read also: Email Marketing Vs Marketing Automation: A Marketer’s Guide

Wrap up

All the tools above are good in their unique way. Your choice will depend on your objectives, business size, and budget. To help you decide, we discussed the best marketing automation tools, their pros and cons, unique features, and pricing.

HubSpot and EngageBay are your best options if you are looking for an all-in-one automation tool. SocialPilot or Sprout Social if you want to work with a social media automation tool. Zoho analytics if you want a tool that combines extensive data reports and marketing automation.

Pardot and Marketo Engage are excellent if your core need is lead generation.

With EngageBay, you can do everything from email marketing to social media to customer relationships and lead generation. The software has flexible pricing with the required features for you as a solo financial advisor or a bigger advisory firm.

Book a demo with one of our experts, or start for free today.

👉 Have you tried our email templates? Share your experience in the comments below, and let us know how they worked for your campaigns!