In 2025, the payment gateways market will rake in $37.59 billion, with a projected compound annual growth rate or CAGR of up to 17.3%.

For the uninitiated, a payment gateway is an eCommerce service provided by third-party merchants to handle payments, including direct or credit/debit card payments. Brick-and-mortar, hybrid, and eCommerce companies use these gateways every single day.

Without payment gateways, we wouldn’t have secure transactions, eroding customer trust. In 2025, as we as a society become increasingly reliant on online payments, there’s a growing need for robust and secure payment gateway solutions to meet customer expectations and security standards.

That’s why now is a great time to dig deep into payment gateways, equipping your business with the understanding you need to use them fully and keep your transactions secure.

In this blog post, we’ll take a look at what a payment gateway is, as well as its key features, the right way to set one up, and five of the best payment gateways.

Table of Contents

Key Takeaways

- Payment gateways provide customers with secure checkout options, including multi-currency support and fraud protection.

- Selecting the right payment gateway requires comparing features and fees while keeping scalability, support, and flexibility in mind.

- Integrating and managing payment gateways leaves you with plenty of leeway, so you can set up the gateway however it suits your level of technical expertise.

Understanding Payment Gateways

Let’s start this journey by explaining what payment gateways are and the types you can select from.

What is a payment gateway?

Although they sound complex, payment gateways are extremely common. For example, PayPal is a payment gateway, as is Stripe. These front-end platforms accept online and in-person payments, ensuring the order goes through, the eCommerce company receives its payment, and the customer is happy.

The payment gateway achieves these objectives by linking to a payment processor. It will then send the transaction data to the eCommerce company’s acquiring bank. From there, the payment data goes to the customer’s issuing bank.

A payment processor or issuing bank will approve the transaction based on the type of payment the customer used and the amount they paid (if they have that much in their bank account). If all is well, the payment gateway will receive the good news and send it to the eCommerce business.

Of course, if the transaction is denied for any reason, the payment gateway also gets wind of this and lets the eCommerce business know. All this happens seamlessly and in real time.

Besides payment processing and authorization, payment gateways also take care of these important tasks:

- Fraud prevention and detection: Fraud happens, but it happens less thanks to payment gateways. Measures such as card verification value and address verification system checks can determine if fraudulent activity has occurred, such as a transaction with a stolen card. The payment gateway can block the fraudulent charge before it hits the customer’s account and they have to resort to locking their credit.

- Encryption: If your financial order data flying around between the bank and payment gateway makes you nervous, be aware that the best payment gateways use encryption to safeguard it from nefarious characters.

- Data reporting: Payment gateways are also excellent at collecting data, from refund request rates to transaction history. eCommerce companies can request data reports to determine the success of their business and make improvements as needed.

Types of payment gateways

Now that you’ve learned the power of payment gateways, let’s look at the various types your business can use.

- Hosted gateways: This kind of gateway will redirect the customers away from your eCommerce site and to a third-party website. There, they can finish the checkout. For example, if you buy a product on a retail website, you might get redirected to PayPal to check out. While secure, hosted gateways add an extra step to the checkout process and thus make purchases inconvenient for customers.

- Self-hosted gateways: Oppositely, a self-hosted gateway is one you host on your website as the eCommerce merchant. You can customize the entire checkout experience, expediting it for customer convenience. However, custom gateways can require a lot of expertise, and if there are security concerns, the onus is on you, not a third-party payment gateway.

- API-hosted gateways: Utilizing the power of API, an API-hosted gateway can sync with your app and/or website. Like a self-hosted gateway, using API gives you more options to align the checkout process with what your audience is looking for. Still, these gateways can be technical and require more expertise than the average payment service.

- Local bank integration: The last type of payment gateway is local bank integration. This payment method links with a customer’s local bank, which is efficient for local purchases. However, local bank integrations make less sense outside of your prescribed region.

Read also: eCommerce Transactional Email Optimization — What to Do & Not to Do

Key Features of Payment Gateways

So many payment gateways are out there, so how do you choose? Here are some top criteria that should help in your decision-making.

Security and compliance

I already discussed how payment gateways can offer secure encryption during data transfer and fraud prevention and detection. Besides that, gateways also provide PCI DSS security and compliance.

In other words, the gateway is certified for protecting credit/debit card and other payment information the average customer doesn’t want prying eyes seeing.

Multi-currency support

As you grow your eCommerce business, you’ll begin accommodating customers from all over the world. Your payment gateway should offer multi-currency support immediately, even if you don’t initially use it, and offer various currency options.

This small addition feels very inclusive to your audience, which could inspire them to purchase more of your products and tell their friends and family about you.

Recurring billing and subscriptions

While this doesn’t work for all kinds of products, recurring subscriptions and billing are excellent for some eCommerce stores.

I’d recommend this option if you sell any non-prescription medication or treatment, supplement, skincare or beauty product, pet supply, protein powder, and/or food supplies.

Recurring subscriptions, such as monthly or bimonthly, ensure the customer never runs out of what they need. Your eCommerce business can also expect reliable revenue, which makes it easier to predict longer-term expenses and income.

Integration with eCommerce platforms

The eCommerce platforms you rely on in your day-to-day business should integrate with your payment gateway. Sometimes, integration is simple, allowing you to add a plug-in, and voila, that’s it.

You might need to implement code in other cases, but at least it’ll be done.

Read also: The 6 Best eCommerce Platforms for Startups

How to Choose the Right Payment Gateway

Are you ready to select a payment gateway for your eCommerce business? That’s excellent! I’ll share my favorites in the next section, but proceed with these criteria in mind for now.

Evaluating costs

For all the services they offer, how do payment gateways make any profit? They usually take a cut out of every transaction, known as the transaction fee. The amount varies, but the standard is 2.9%.

However, the costs of a payment gateway go even further. For instance, there are:

- Setup fees: These initial costs are to get set up with the payment gateway. Not all gateways charge this fee. For example, you can set up Stripe for free.

- Ongoing fees: Some payment gateways charge monthly fees instead of per-transaction fees. If you must pay these ongoing fees, your continuous payment guarantees you can use the gateway.

The right payment gateway for you will be affordable for your small business budget.

Compatibility and integration

Before you confirm which payment gateway to select, check its compatibility with the tools you already use.

Integration should be hassle-free so you can continue to use your existing eCommerce platform and other existing systems.

Customer support and reliability

You may sometimes need help with your payment gateway, or perhaps there’s downtime, and you need to know when your gateway will be operational again. In these and other situations like them, you can’t put a price on fast, reliable customer service.

You should have many options for connecting with the customer support team, whether through live chat, phone, or even video chat if you need it. If they use AI chat, it should be responsive and helpful.

The goal of the chat should be to fix your issue within the same day so you can continue serving your customers.

Scalability and flexibility

The last consideration is the biggest. Your gateway should be ready to grow as your business does, accommodating your changing needs and an increasingly large audience. This will prevent you from changing your payment gateway every few years as your business grows.

Read more: eCommerce Support Technologies to Help Build Your Moat

5 Most Popular Payment Gateways

You’re about ready to select a payment gateway, and by the time you’re through this section, I’m confident you will be ready. Here are five top payment gateways courtesy of our experts at EngageBay for you to peruse.

1. Stripe

As one of the best-known gateways, Stripe is a trusted payment service provider for managing, settling, reconciling, processing, and accepting payments.

If you’re looking for insights and reporting, you’ve got it. Accepting payments is also easy, thanks to the prebuilt payment forms and AI payments Stripe allows.

You can take all sorts of payments on Stripe, including:

- Multiple currencies (with automatic currency conversions)

- Cash-based vouchers

- Buy now, pay later

- Bank redirects

- Bank debits

- Wallets

- Cards

Stripe has a dashboard mobile app, mobile web, mobile customer interface, Android SDK, and iOS mobile service. You can check your stats and sales in real-time using the Stripe Dashboard.

The standard transaction charge on Stripe is 2.9% plus 30 cents for domestic orders, but custom charges are also possible.

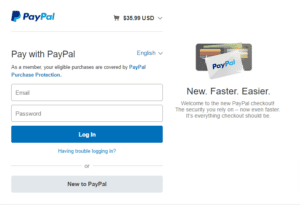

2. PayPal

It’s free to sign up for a PayPal account. Once you do, you can begin using its wealth of features. PayPal has access to more than 200 markets worldwide and doesn’t require you to convert currency when it can do it for you.

PayPal Link negates the need for any setup, and you can also waive the monthly fees, which is awesome. PayPal is compatible with many shopping carts, processors, and merchant account services.

The rate of integrations is awesome, and you won’t have to stress about security with PCI compliance. You can accept various payments using PayPal as your payment gateway, including debit and credit cards. You can also allow your customers to buy now and pay later using PayPal Credit without paying anything extra.

PayPal has two payment gateway options: Payflow Link or Payflow Pro.

Payflow Link uses PayPal-hosted checkouts, PCI-compliant templates, custom or embedded templates, and PayPal Credit or standard payments. It’s free to use the Payflow Link.

For $25 a month, Payflow Pro lets you customize anything and everything you want during checkout with no limits. Better yet, everything is still PCI-compliant.

Whether you pay for Payflow or not, you’ll still have to contend with the following PayPal fees:

- 49% plus a fixed fee for commercial transactions

- 99% plus a fixed fee for standard debit and credit card payments

- 99% to send or receive money for goods and services

- 49% plus a fixed fee to pay using Venmo

- 29% plus 0.09 cents for QR code transactions through a third-party integration service

- 29% plus a fixed fee for QR code transactions

- 49% plus a fixed fee for PayPal Guest Checkouts

- 49% plus a fixed fee for PayPal Checkouts

- APM transaction rates for Alternative Payment Methods

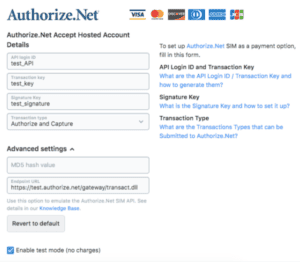

3. Authorize.net

Authorize.net could check what you’re looking for in a payment gateway. What I like about it is how Authorize.net tries to make payments simple. You have enough to worry about as a business owner, and payments shouldn’t be one of them.

You can customize the level of fraud protection to suit your business. Invoice digitally and keep your customers’ information for next time. Plus, all the payments you need are available and accepted, such as:

- Apple Pay

- JCB

- PayPal

- eCheck

- American Express

- Mastercard

- Visa

Importantly, you can set up recurring payments through Authorize.net.

When only using its payment gateway, the monthly fees for Authorize.net are $25, although the setup fee is free. The processing rates for each transaction are 10 cents plus a daily batch fee of up to 10 cents.

If you add eCheck to the payment gateway services, you’ll pay $25 monthly with a free setup fee. eCheck processing fees are 0.75 cents, and credit card transaction fees are 10 cents per day with a batch fee of 10 cents.

The setup fee is still free if you use the all-in-one service, but the monthly gateway charges are $25. Additionally, the processing fees per transaction are 2.9% plus 30 cents.

4. Square

You can expect all your payment needs handled with Square’s point-of-sale system, from payments to add-ons, customer support, operations, and checkouts.

Expand the types of credit cards you accept, with reward cards, American Express, Discover, Mastercard, and Visa all accepted at one rate. You can also accept contactless payments at your brick-and-mortar store.

Set up checkout with features such as item modifiers, custom item grids, and itemization. As for transactions, you can accept offline payments, offer automatic discounts, and set up custom tip amounts.

Square POS will sync your in-store and online sales inventory so you never have to skip a beat, and Square even has social media support for TikTok, Instagram, and Facebook (aka social selling).

Here are Square’s fees:

- 5% plus 15 cents for manually entered transactions

- 3% plus 30 cents for invoices

- 3% plus 30 cents for Square Payment Links online

- 9% plus 30 cents for online processing

- 6% plus 10% for in-person transactions

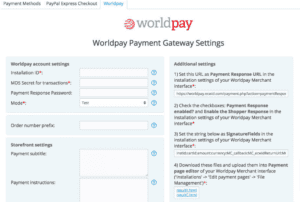

5. Worldpay

The customization and flexibility of Worldpay could be just what your eCommerce business needs at this stage regarding payment gateways. Its payment integration services include embedded payments, payment management, and APIs. You can also accept many types of secure payments.

It’s no wonder that companies from ResMan to Kangarootime, fitDEGREE, FieldRoutes, and Neon One all use Worldpay. It’s renowned for its international transactions especially.

How to Successfully Implement a Payment Gateway

As integration-friendly as your payment gateway may be, you must still implement it into your existing online store. I’ve talked enough about why that’s important, so let’s chat about how to do it.

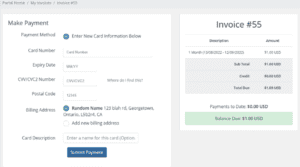

Step-by-step guide

I’ll use PayPal as an example, but be aware that the integration process can vary from payment gateway to gateway. For example, you need a merchant account and API keys on Stripe.

You have three options on PayPal: use its API, integrate with the Payments Standard, or add PayPal Buttons.

The API integration is as follows:

- Check your PayPal API settings, then select whether you want to host and encrypt through your API or use PayPal’s.

- Upload buttons for automatic billing, subscriptions, add to cart, donations, and buy now, then add the font, size, color, and price for each button.

- Determine each button’s name-value pair or NVP and standard communication protocol or SOAP rules.

- Add API code for buttons and test them using the PayPal Sandbox.

Linking PayPal Payments Standard with eCommerce providers like Wix, Shopify, or WooCommerce requires a PayPal Business account. Then, do the following:

- Go to your eCommerce admin portal and choose PayPal Payment Standards in your settings.

- Log into PayPal through the eCommerce platform to connect PayPal.

The third option, adding a PayPal Button to your eCommerce website, is recommended if you sell only a few products. You can select subscription, automatic billing, donate, add to cart, and buy now from the PayPal buttons.

You will once again need a PayPal Business Account, then follow these steps:

- Go to the App Center on PayPal and select the PayPal Checkout option.

- Pick the Choose a Way to Integrate option, then set it up for individual items.

- Adjust the button, save the code, and paste it onto your website.

Best practices

Now that you’re using a payment gateway review these best practices to maximize its efficiency:

- Stay aware of changing legal standards to ensure your eCommerce business remains compliant.

- Increase the number of payment options you provide to meet consumer demands.

- Likewise, offer more international currencies to make your eCommerce business more inclusive.

Read more: 8 Game-Changing eCommerce Integrations for 4X Growth

Conclusion

Payment gateways are a significant part of the eCommerce process, providing customers with a secure and seamless payment experience.

Choosing the right payment gateway for your business is only the beginning. You must also be ready for ongoing optimization and evaluation of the gateway setups you use to keep pace with customer expectations and technological advancements.

EngageBay is an all-in-one marketing, sales, and customer support software for small businesses, startups, and solopreneurs. You get email marketing, marketing automation, landing page and email templates, segmentation and personalization, sales pipelines, live chat, and more.

Sign up for free with EngageBay or book a demo with our experts.

Frequently Asked Questions (FAQ)

1. What is a payment gateway, and why is it important for my online business?

A payment gateway takes care of customer transactions, ensuring a streamlined checkout process so you can maximize the success of your eCommerce business. Without them, your business would handle all checkouts yourself, which can be time-consuming and expensive.

2. How do I choose the best payment gateway for my eCommerce site?

Consider factors such as reputation (based on reviews and testimonials), ease of use, flexibility, level of support, and scalability when browsing payment gateways.

3. What are the main differences between hosted and self-hosted payment gateways?

A self-hosted payment gateway doesn’t require a third party to collect the customer’s data. All checkouts take place directly on the eCommerce website.

4. How can I ensure my payment gateway is secure and PCI-compliant?

A PCI-compliant payment gateway will have active certification and encryption processes to prove its security. The certifications should be current to confirm ongoing compliance.

5. What costs should I consider when selecting a payment gateway?

Some payment gateways charge an initial setup fee. You may have to pay a monthly fee to continue using the service. All payment gateways also charge transaction fees for each order a customer completes.

6. Can I switch payment gateways if I’m unsatisfied with my current provider?

Sure, you can, especially if one of their competitors offers a better rate. However, it depends on whether you signed a contract or are locked into working with one gateway for a certain period.

7. How do payment gateways handle international transactions and multiple currencies?

Most payment gateways provide exchange rate management tools and currency support to make international transactions feasible for eCommerce business owners.

8. How do I integrate a payment gateway with my existing eCommerce platform?

Payment gateways like PayPal and Stripe often integrate with a button or plug-in. You can also use more complex API integration if you have the time and know-how.

9. What should I do if my payment gateway experiences an outage?

Contact the payment gateway to get an estimate of how long the outage will last. Next, let your customers know what’s going on and how long it will be expected to impact them. Continue to provide real-time updates until the issue is resolved.

The blog highlights top payment gateways, focusing on secure transactions, easy connection, and improving user experiences.